FCA HQ

Financial services firms received 1.85m complaints in the first half of 2025, a 4% increase from the first six month of 2024 when there were 1.78m complaints, according to new data from the FCA.

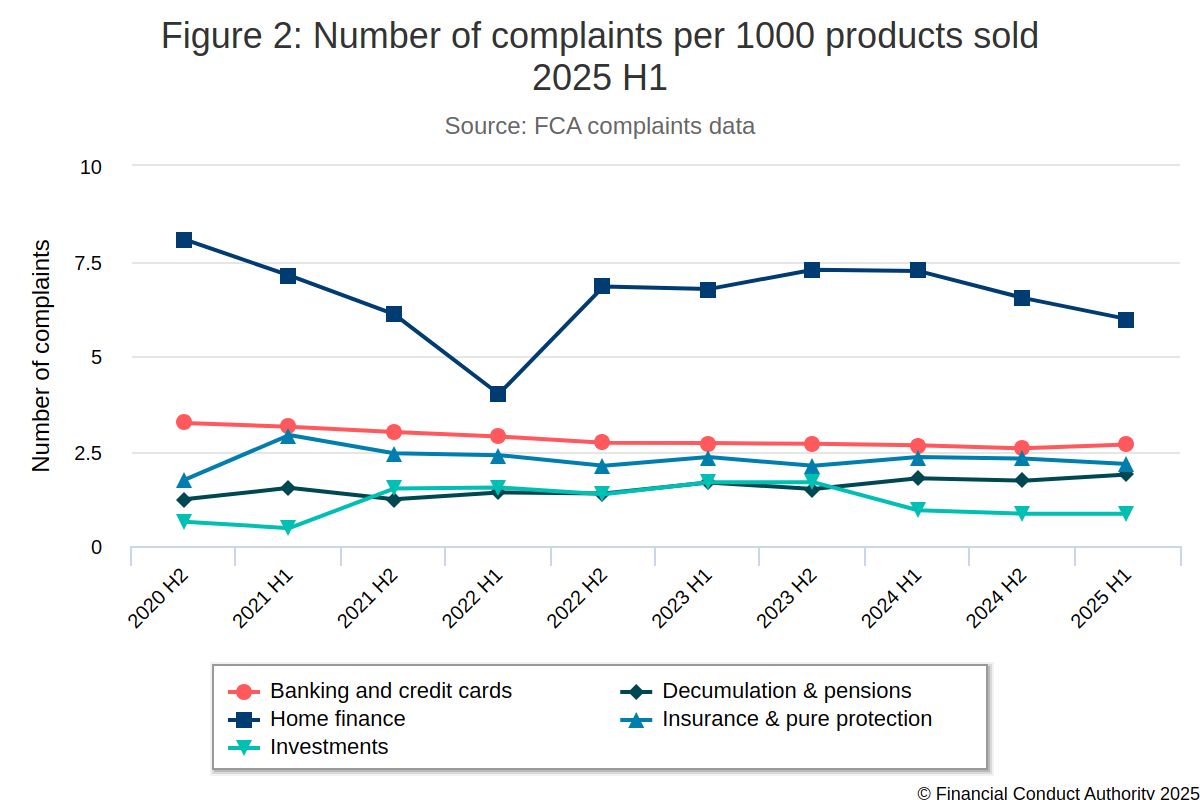

Since 2021 first half year complaints have stayed relatively constant between 1.7m and 2m.

The data reveals that the total amount of redress paid in the first six months of the year was £283m, a 20% increase on the £236m paid out in the second half year of 2024.

The average compensation payment climbed from £207 to £238. The percentage of complaints that were upheld by firms remained around 57% between the second half of 2024 and the first half pf this year.

The figures revealed that the product groups that experienced an increase in their complaint numbers were:

The product groups that experienced a decrease in their complaint numbers were:

Phil Smith, senior actuarial consultant at Broadstone, said: “Given the scrutiny on consumer outcomes and fair treatment from the regulator, it is perhaps unsurprising that we are seeing increases in complaints.

“With the number of complaints being upheld remaining consistently high as well as increases in both total and average compensation payments, it is clear that firms have work to do to ensure they are treating their customers fairly.

“Redress remains a costly outgoing for firms – as the ongoing motor finance case should be a reminder of – so it quite literally pays to treat customers well.”