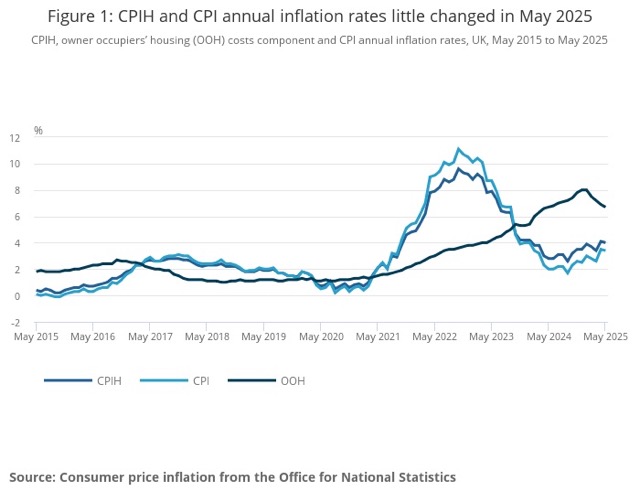

Key inflation rates for May 2025. Source: ONS

CPI inflation eased slightly in May to 3.4% from 3.5% in April, ONS said today.

Experts said that inflation remained "sticky."

The April figure was initially published as 3.4% but revised upwards in a correction to 3.5% due to a revision of the data. ONS said the overall impact was that inflation was little changed in May.

ONS acting chief economist Richard Heys said: “A variety of counteracting price movements meant inflation was little changed in May. Air fares fell this month, compared with a large rise at the same time last year, as the timing of Easter and school holidays affected pricing. Meanwhile, motor fuel costs also saw a drop.

“These were partially offset by rising food prices, particularly items such as chocolates and meat products. The cost of furniture and household goods, including fridge freezers and vacuum cleaners, also increased.”

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 4% in the 12 months to May, compared with 4.1% in the 12 months to April. On a monthly basis, CPIH rose by 0.2% in May, compared with a rise of 0.4% in May 2024.

The Consumer Prices Index (CPI) rose by 3.4% in the 12 months to May, compared with 3.5% in the 12 months to April. On a monthly basis, CPI rose by 0.2% in May 2025, compared with a rise of 0.3% in May 2024.

The largest downward contribution to the monthly change in both CPIH and CPI annual rates came from transport. Upward contributions came from food and furniture and household goods.

Core CPIH (CPIH excluding energy, food, alcohol and tobacco) rose by 4.2% in the 12 months to May, down from 4.5% in the 12 months to April. The CPIH goods annual rate rose from 1.7% to 2.0%, while the CPIH services annual rate slowed from 5.8% to 5.3%.

ONS said that CPIH and CPI inflation rates and indices were both overstated in April as a result of an error in the Vehicle Excise Duty (VED) component.

Susannah Streeter, head of money and markets, Hargreaves Lansdown, said: "Sentiment remains subdued as investors brace for the Iran-Israel conflict to intensify. Oil prices remain sharply higher on the week, as President Trump has called for Iran’s ‘unconditional surrender.

"Given that a quarter of global oil supplies flow through the narrow strait of Hormuz off the Iranian coast, there is increasing concern that a prolonged war will lead to a significant disruption of supplies. Brent Crude is trading above $76 a barrel, around 10% higher compared to when the attacks on Iran began, at levels not seen since February. Already it appears some ships are avoiding the region.

"Just as sticky inflation is already a concern the surge in energy prices and a potential ramp up in shipping costs is set to cause more trouble. It’s certainly an extra headache for policymakers deciding on interest rate cuts this week."

Dean Butler, Managing Director for Retail Direct at Standard Life, part of Phoenix Group said: “Summer is on the horizon and inflation is refusing to cool down, with May’s inflation figures showing that the UK’s price pressures remain persistent. At 3.4%, the Consumer Price Index (CPI) sits significantly above the Bank of England’s 2% target, and while many had hoped for a smoother path to interest rate cuts in 2025, it seems likely we’ll continue to see a cautious approach from the Bank, particularly in the context of increasing global instability. Any further cuts this year will probably be incremental, as the Monetary Policy Committee looks to balance the UK’s need for growth with the risk of fuelling inflation."

Richard Carter, head of fixed interest research at Quilter Cheviot, said: “While inflation has steadily declined from its double-digit peak, today’s data reinforces just how tricky the final stretch of disinflation can be.

“The Bank of England is widely expected to keep interest rates on hold this week, regardless of today’s inflation print. The situation in the Middle East and its potential to drive further energy-related inflation means policymakers will be wary of cutting rates too soon. Greater clarity on the inflation outlook will be needed before the Bank feels confident enough to make its first move."