Schroders website

Four in five investors, 80%, are somewhat or significantly more likely to increase their use of actively managed investment strategies in the year ahead, according to the latest Schroders' Global Investor Insights Survey.

The firm said investors are turning to active management to strengthen portfolio resilience and capture specific investment opportunities amid mounting economic uncertainty.

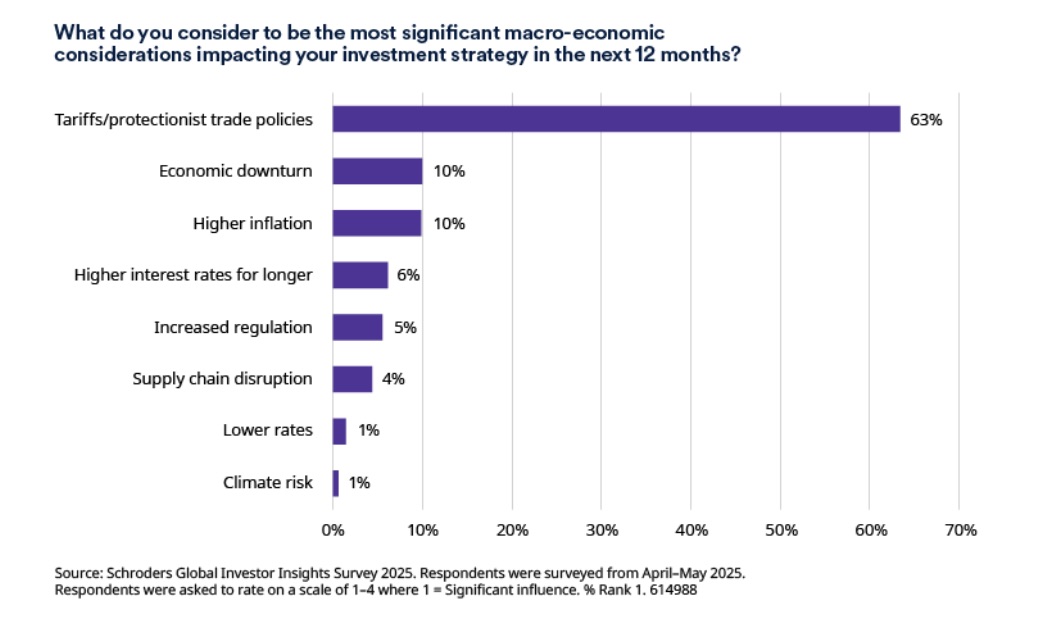

The findings follow significant market volatility earlier this year, largely triggered by the US Government’s decision to introduce wide-ranging trade tariffs.

Trade tariffs were selected by nearly two-thirds of respondents, 63%, as the biggest macroeconomic concern, more than six times the next highest perceived risk.

'Portfolio resilience' was the overwhelming top priority for portfolios for the next 18 months, selected by more than half of all surveyed (55%).

Of the investors who prioritised portfolio resilience, fourth-fifths, 82%, said they are increasingly looking to harness active management.

Johanna Kyrklund, group chief investment officer at Schroders, said: “Active management is indispensable amid today’s fragmented markets. With four in five investors set to increase their allocation to actively managed strategies this year, it’s clear they value a selective and adaptable approach.”

He said that financial markets are still adjusting back to structurally higher interest rates, made painful in many cases by high levels of debt. “This is raising questions about future market trends and the value of passive approaches in a period of greater uncertainty.”

He added that: “Resilience now tops the investment agenda, as the rising tide no longer lifts all boats. In this environment, active strategies provide the control investors need to manage complexity, create portfolio resilience and seize opportunities.”