FCA to tackle risk of 'harm' from Pension Freedoms

- Thursday, 28 June 2018

- Articles

The Financial Conduct Authority has launched a consultation today on measures aimed at protecting consumers, improving engagement and promote competition in the retirement income market.

Read more...Retirees to bequeath rather than spend says research

- Tuesday, 12 June 2018

- Articles

Retirees are set to bequeath rather than spend much of their accumulated wealth, new research has indicated.

Read more...Pension Freedoms paper reveals Financial Planner concerns

- Friday, 01 June 2018

- Articles

A wide-ranging report looking at Pension Freedoms and their impact and implications has been published by AKG.

The ‘Pension Freedoms Paper, Grasping the nettle: Working together to achieve better retirement outcomes’, highlighted key areas of concern among pension savers, Financial Planners and Paraplanners.

The report found that among consumers there was high awareness of the Pension Freedoms changes, with 73% of respondents knowing about them three years after their introduction.

The paper read: “Overarching awareness of the pension freedoms changes appears to be good but we need to ensure that this awareness improves further in the next few years and that understanding of the changes, their impact and the options now available to consumers is also improved.”

The research raised a red flag over retirement confidence, with nearly a third (32%) saying they felt less confident in their retirement plans than they did five years ago, and 39% answering ‘don’t know’.

Just 29% said they were more confident.

The report advised that the industry “needs to help to improve consumer confidence about retiring and associated retirement plans.”

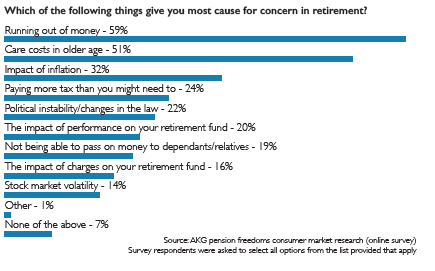

Key concerns among consumers were running out of money (59%), care costs in older age (51%) and impact of inflation (32%), but they were also worried about being able to pass on money after their death (19%) and paying more tax than they need to (24%).

A summary of the findings read: “In order to better understand consumers and service their requirements in retirement we need to get a handle on the things that give them most cause for concern.

“AKG’s consumer research found that the biggest cause for concern in retirement is running out of money.

“This is closely aligned to the key concerns that advisers have for their clients.”

On tax concerns it read: “Prior to the pension freedoms, the pension pot was typically utilised for income before other assets.

“Now, because of the tax benefits, pensions seem to have become the main weapon in conservation of assets and protection of client estates.”

The report called for better financial education to allay fears over retirement savings.

It read: “Better education on money, including spending requirements and planning, pensions and investments is vital.

“Whether this be for school kids, early stage auto-enrolment scheme members or those approaching retirement.

“It’s important to consider what type of education and intervention might be required at different life stages – the same mantra applies for information and guidance – but we can’t continue to kick education into the long grass.”

Turning to the adviser scene, the report looked at changes in the wake of Pension Freedoms and concerns felt by Financial Planners, Paraplanners and advisers.

The report showed that 77% of advisers said they were now spending more time on retirement advice and concluded that Pension Freedoms were “good for business.”

It added: “The pension freedoms changes have largely been good news for advisers.

“They are busier with the provision of retirement advice.”

The report also revealed that more than a quarter (27%) of advisers said the minimum investible amount/pension fund size for servicing clients is now higher, with only 9% saying it was lower.

AKG said its research “alluded to the shift upmarket for some businesses.”

The report showed the main concerns advisers had for clients, with investment volatility being ranked a primary concern by 48% of respondents, this was close followed by running out of money (45%) and sequencing of investment return risk (41%).

Other concerns included clients choosing to take more money against advice (28%), Inheritance Tax planning (8%) and the impact of inflation (27%).

The main areas of concern advisers had for their businesses were regulatory change (77%), investment volatility (59%) and political volatility (47%).

Other worries included recruiting new Paraplanners/advisers (12%) and developing new Paraplanners/advisers (6%).

The report read: “The top three concerns are all environmental with one and three relating to regulatory change/challenge and political volatility.

“Investment volatility, given the popularity of drawdown, is a clear concern for adviser businesses.”

Matt Ward, communications director at AKG, said: “For a variety of reasons, the pensions/retirement market has become and will remain a fascinating place over the coming years.

“Opportunity will knock for market participants and other stakeholders for several years to come.

“But we are only three years into the post-pension freedoms environment and there is more experience to be gained.

The number of ‘baby boomers’ approaching retirement is well documented, many of whom are yet to make their retirement decisions.

Companies across the market must therefore continue to learn quickly from those customers experiencing the initial stages of Pension Freedoms, and adapt their propositions accordingly, to better target future business opportunities and to help people achieve positive outcomes.”

He added: “In the three years since the introduction of pension freedoms we have already seen that it won’t all be one-way traffic in terms of opportunities realised, and that there will be challenges and casualties along the way.”

Read more...

1.7m clients ‘at risk’ without Lasting Power of Attorney

- Thursday, 24 May 2018

- Articles

New findings revealed a Pensions Freedoms ‘blind spot’ because 79% of clients had failed to set up a Lasting Power of Attorney.

Read more...