Rachel Reeves with the Budget box

The thresholds at which people pay income tax will be frozen until the end of the 2030/31 financial year it was revealed in the Budget, longer than most experts predicted.

Extending the freeze for another three years will raise £8bn, the Chancellor Rachel Reeves said.

The freeze extension was expected, said Sarah Coles, head of personal finance, Hargreaves Lansdown. She said: “It comes as no surprise, given it has been such an effective stealth tax already.

"Fiscal drag has hauled more than 6m more people into paying income tax, and 3.36m more into paying higher or additional rate tax. We’ve had to hand over an extra £89bn in income tax this year – compared to 2021/22 – as a result.”

{load position hidden2}

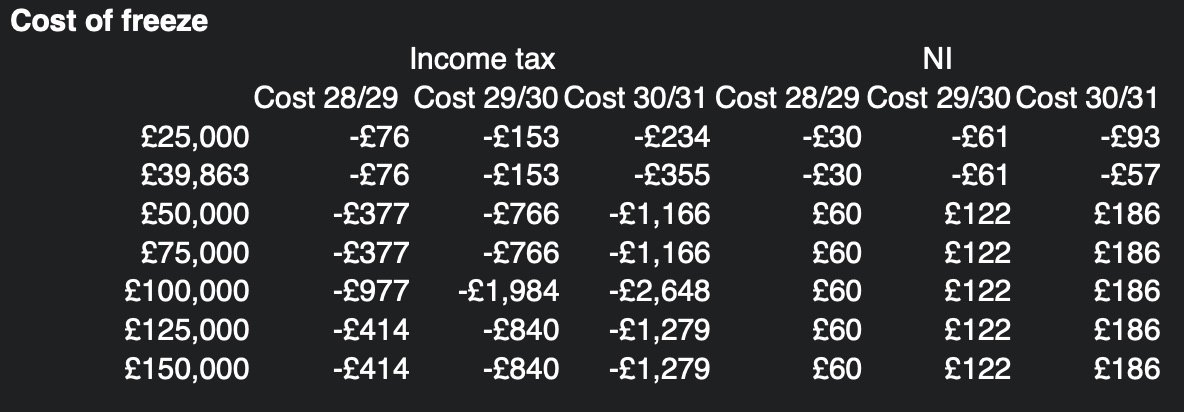

She said the freeze means that every pay rise will mean more people paying more tax, and more tipping over into paying higher rates with someone earning £50,000 this year paying £8,165 more in tax over those three years as a result.

Ms Coles said: “It’s not just the tax on earnings that’s affected. When you start paying higher rate tax, your personal savings allowance shrinks, from £1,000 for basic rate taxpayers to £500 for higher rate taxpayers, and disappears altogether for additional rate taxpayers. You also pay a higher rate of capital gains tax when you cross into paying higher rate tax, and your dividend tax rate rises as you cross each income band.”

Rachael Griffin, tax and financial planning at Quilter, said: “The multi‑year freeze on income tax thresholds has now been extended, locking households into one of the most powerful stealth tax rises in modern fiscal policy.

“With wages rising while thresholds stand still, millions more people will drift into higher tax bands regardless of whether their real living standards have improved. What had initially been framed as a temporary measure has now seemingly become a structural feature of the tax system and will significantly increase the tax take over the rest of the decade.”

Source: Quilter, calculations assume 3% inflation and 5% wage growth

Had the £12,570 personal allowance risen in line with inflation from when it was first frozen in 2021 until now, it would be worth £15,714. Had the £50,270 higher rate threshold done the same, it would be worth £62,845 today.

Nigel Green, CEO of deVere Group, said: “The decision locks workers into relentless fiscal drag and pulls more income into higher bands year after year.”

He said for advisers working with internationally-mobile clients, “the trajectory is unmistakable. It is precisely the type of structural change that triggers relocation planning.”