Retail fund sales data from the Investment Assocation

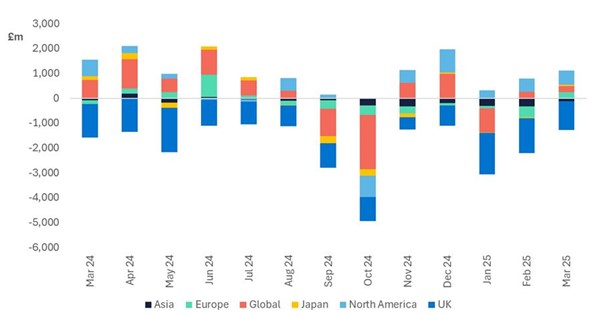

Funds reported retail outflows of £3bn for first quarter, despite investors placing £507m into funds in March, according to the latest data from the Investment Association.

With concerns over President Trump’s new tariffs, rising inflation and an uncertain interest rate outlook, the first quarter of this year was the worst for retail fund sales since the £8.6bn outflow recorded in Q4 2023.

The first quarter saw net retail outflows from equity funds of £3.9bnh, following a £3.4bn outflow in Q4 2024.

Miranda Seath, director of market insight and fund selectors at the Investment Association, said: “Q1 was no easy ride for investors and outflows suggest that we’ve seen a drop in confidence following the more positive end to 2024. Whilst markets were initially buoyed by Trump’s victory in the US, volatile policymaking and uncertainty around the future of global trade make it challenging for investors to make clear cut decisions. This is reflected in the notably strong inflows into money market funds in March, as investors take a ‘wait and see’ approach.

“This uncertainty shows no sign of abating as investors await the full impact of the fallout from Trump’s global tariffs. Recognising the key headwinds and tailwinds for global markets, many investors will carefully assess their next move.

“If tariffs contribute to a rise in inflation, after a positive 2024 where inflation came significantly under control, we may see a pause in interest rate cuts. This has implications for future economic growth and equity and bond markets.

“Until we see more stable and consistent policy, we are likely to see further market volatility. Investors that started investing over the pandemic have experienced the market turbulence of 2022 and seen their investments rebound; their experience could help them navigate the coming months. Newer investors will have less experience of these conditions and interest rates available on cash savings are still fairly high, which could draw money away from funds if investors are worried about volatility.

Despite the gloomy quarterly figures, March saw several fund sectors return to inflows.

Equity funds saw their first net inflow of 2025, with net retail sales of £535m in March. North America continued to dominate equity inflows with net sales of £570m. UK equity outflows eased slightly from February but remained high at £1.2bn.

Money market funds saw £1.2bn in net retail sales.

Index trackers took in net £1.4bn in March. Equities dominated tracker inflows (1.4bn), with the strongest inflows to Global equity trackers (£617m).

However, whilst some sectors saw a return to inflows, others saw a reversal in fate.

Multi asset funds saw inflows soften to £149m, from £398m in February.

Bond funds saw outflows of £.13bn in March, with outflows of £1.2bn from across the Corporate Bond sectors. This was a reverse from fixed income inflows of £159m in February. Bond funds saw net retail outflows of £957m for the quarter.