Financial Planning firm Fidelius has selected Hubwise as its new investment platform.

Liontrust Asset Management has reported an increase in assets under management of 61% - from £6.5bn to £10.5bn over the last year.

Half of all investors are in the dark about the fees charged by their wealth managers, leading to an accusation that firms are abusing the trust of investors.

The Personal Finance Society has recruited pensions experts and practitioners to help launch a new Pensions Advice Taskforce which will aim to provide “strategic leadership” and a voluntary code of professional standards for pension advice in the wake of the Pension Freedoms.

Glasgow-based wealth advisory firm Murphy Wealth plans to move to a new 3,000 sq ft location in the city.

People living with diabetes can, for the first time, buy life insurance knowing that their premiums will never go up and can go down.

The European Court has ruled in favour of a transgender woman who was denied access to her pension.

Schroders has appointed a former CEO of Tilney as its new global head of wealth management.

Self-employed workers should be offered help with financial advice and flexible pension contribution options, according to national Financial Planning firm LEBC.

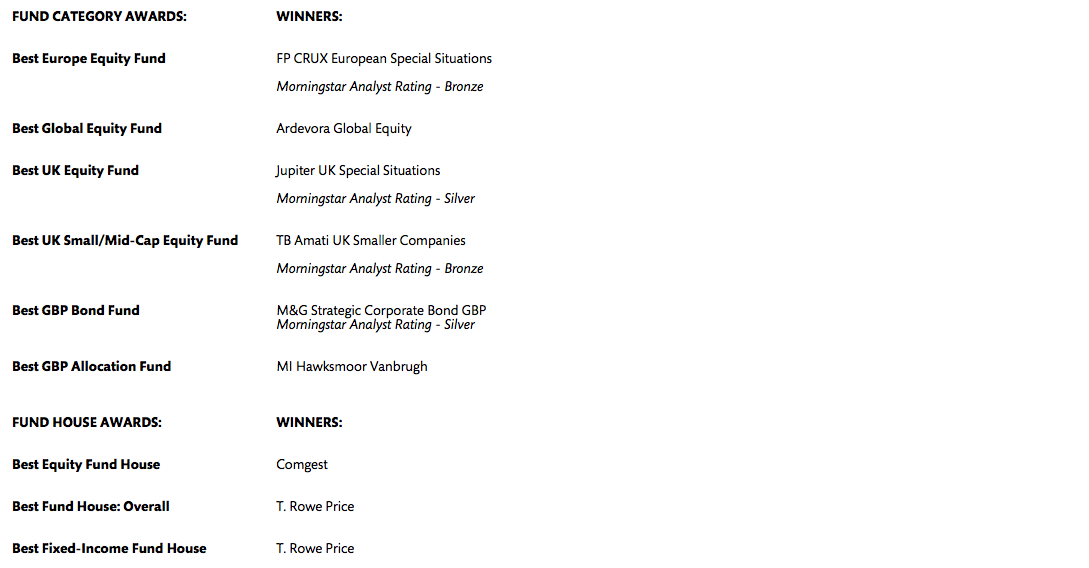

Investment research firm Morningstar has announced the winners of its UK Fund Awards 2018.

The annual Morningstar UK Fund Awards recognise the retail funds and fund groups that added the most value for investors within the context of their relevant peer group in the previous year and over longer time periods.

The company says it selected the winners using a “quantitative methodology” and eligible funds needed a five-year performance track record.

The winners of the Morningstar UK Fund Awards 2018 were:

Jonathan Miller, Morningstar UK’s director of manager research, said: “We saw many strong contenders for the Morningstar UK Fund Awards 2018 and the winning funds and fund houses have demonstrated the ability to earn strong risk-adjusted returns for investors.”

He added: “It’s important for investors to take a long-term view to avoid undue risk.”

Page 1055 of 1769