Nearly eight out of 10 clients (79%) of a leading Chartered Financial Planner firm say that taking advice from a Chartered Planner is “essential” to their financial decision-making.

A client survey for Chartered Financial Planner-led adviser group Fairstone also found that while too many consumers fail to start planning early enough the tide may be changing.

The survey of 1,000 consumers found that more than 40% of people surveyed believed the biggest change to financial advice in the future would be people seeing professional advice ‘as the norm’ and starting at a young age.

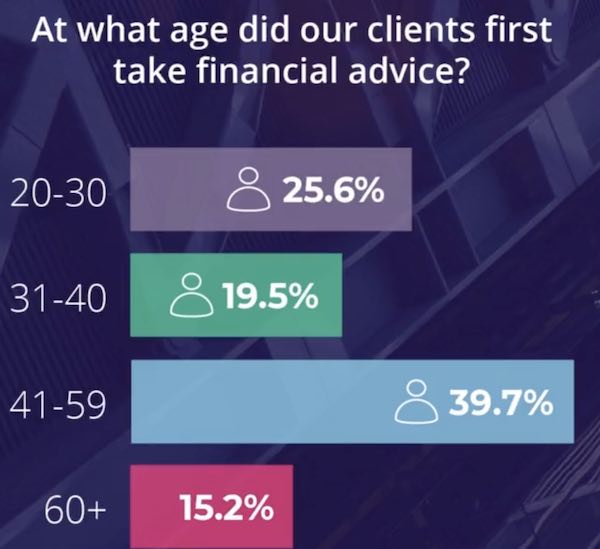

Some 25% of respondents said they started their financial advice journey in their 20s, a noticeable increase from 20% just one year ago.

Despite the positive sentiment, the survey also found that the majority of men and women start their financial ‘journey’ too late, often not looking for professional advice until their 40s or later.

Other key survey highlights included:

- Pension guidance was the main motive for first seeking financial advice (45%), with investment planning (20%) and mortgage advice (14%) being other popular prompts

- 55% of respondents first took financial advice after the age of 40.

- 72% said sustainable investing was important to them (up from 60% in 2019)

For its annual Client Survey Fairstone questioned more than 1,000 respondents on a range of financial issues, including what factors were the most important in Financial Planning.

Source: Fairstone Client survey

Fairstone CEO Lee Hartley said: “It is particularly encouraging to see that more clients are starting their financial journeys at a younger age. We can’t emphasise enough just how important this is.

“However, this is only a snapshot of the broader picture across the UK, which suggests that millions of hard-working people still aren’t saving enough to live on once they’ve finished working.

“More needs to be done across the sector on raising awareness of the importance of seeking financial advice and the very significant value of starting that journey as early as possible.”

Fairstone is based in Newcastle with 40 offices around the UK and manages £13.5bn in funds under management for over 45,000 wealth clients. It is one of the largest Chartered Financial Planning firms in the UK.