Advised platform AUM climbed 4.36% in the second quarter to £671.39bn, according to new data.

The total AUM was up 9.51% compared to the second quarter in 2024.

Platforms recorded net sales of £5.77bn, the highest since Q2 2022, although gross sales slipped slightly falling 1.61% against the record-breaking first quarter.

The data from platform consultancy the Lang Cat showed that outflows continued to fall, dropping 4.11%, to £15.96bn, the lowest since the first quarter of 2024.

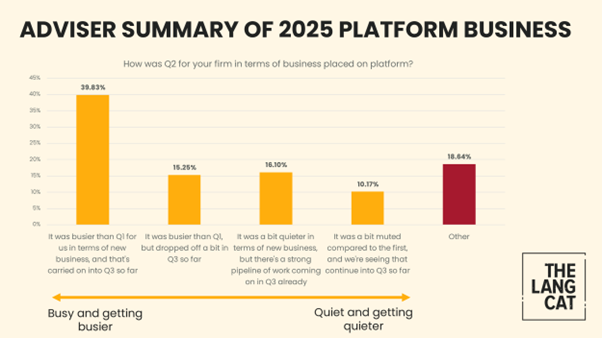

Its research suggests the trend in platform business has largely carried on and will do so into the third quarter meaning there could be a record-breaking year for new business.

Source: The Lang Cat

Rich Mayor, senior analyst at the Lang Cat, said: “We’re seeing a really strong year in terms of new business written by advisers on platforms. Even more encouraging is that advisers we spoke to said just over half of the business they wrote was new money coming onto platforms, rather than a transfer of existing assets from one to another.

“That’s a good indication of future improved gross and net sales for platforms, and an improvement from when we tested this last year where most of the business being written was transfer business.”

In terms of product sales, across all channels ISA gross sales had their best quarter on record and net sales of £711m were the best since Q2 2022. The data also showed a return to positive net sales for ISAs for the first time since Q2 2022.

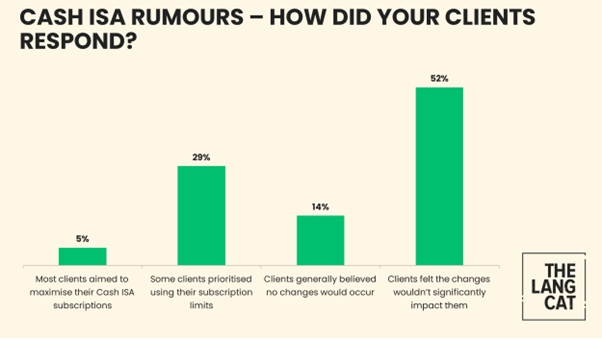

The firm said the reported gold rush into Cash ISAs didn’t affect the majority of advised clients though, with most advisers saying their clients thought they wouldn’t be significantly affected.

Source: The Lang Cat

Mr Mayor said: “In terms of the evolution of investments, we’ve heard some increased noise around access to private markets on platform. We’ve tested this with advisers this month and over half said that access to private markets – either on platform or elsewhere – isn’t needed for most of their clients.

“Just under a third thought they were too complex and had concerns around liquidity, and just under one in twenty saw it as an opportunity for their clients, with the preference of access to private markets being on platform.”