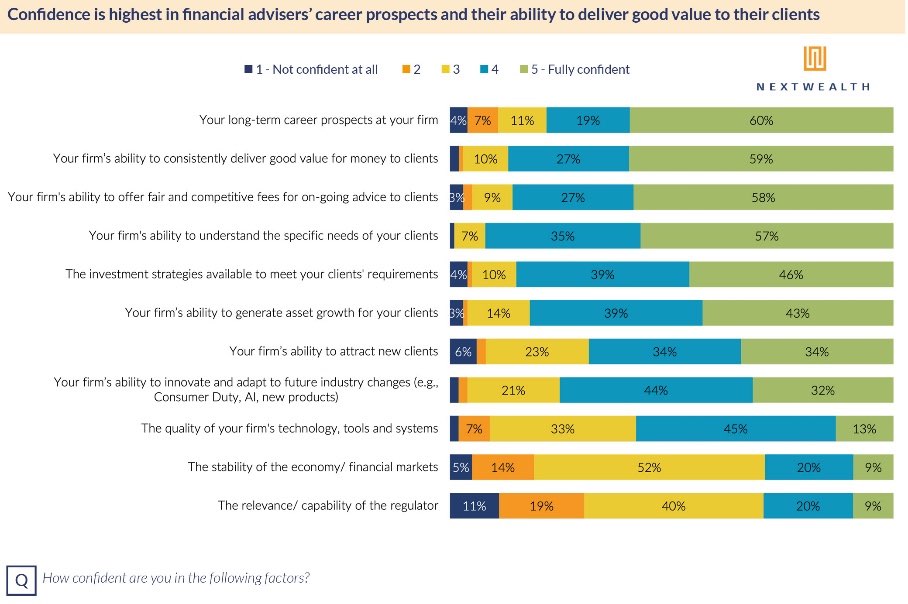

Financial Planners and advisers remain confident in their career prospects but there are some persistent 'stress points', according to a new study.

NextWealth’s latest Financial Advice Business Benchmarks report revealed confidence in personal career prospects has climbed 12 percentage points to 60%.

The financial consultancy said the increased confidence was a possible reflection of the early rollout of AI tools and initial fears about job displacement softening.

The company pointed out that advisers were starting to see AI reduce their administrative load and free up more time for the client work they valued most.

However, NextWealth said the findings showed that employees were less confident that their firms were set up to innovate and adapt to change. They said data quality and tech integration remain weak links.

More positively, almost half of respondents, 47%, said they were working with more clients this year compared to last year.

Source: NextWealth

Heather Hopkins, managing director at NextWealth, said: “Growth, where it is organic, remains a central theme in 2025. What’s new is the shift from coping with regulation to tuning the advice engine for the road ahead – improving outcomes for clients, businesses and advisers, and getting on the front foot.”

She said that behind the benchmarks, financial advice professionals describe a rolling tune-up of the advice engine: standardising journeys, wiring systems together, and improving data fidelity.

She said: “Data quality remains a sticking point for realising the admin efficiencies tech and AI can offer. Poor data quality is to efficiencies what driving with the handbrake on is to fuel economy and it’s not an issue that is going to go awa.,”

Ms Hopkins added that three years on, Consumer Duty remains the biggest driver of change, and its ongoing requirement to monitor outcomes and evidence compliance looks to be a major factor denting confidence. “Ongoing monitoring and evidencing obligations are operationally demanding and many firms continue to struggle with data quality and MI.”

• The report is based on a survey of 263 financial advice professionals, conducted between June and August. Results have been weighted by size of firm by number of advisers to be representative of the whole market.