Canada Life has reported doubled annuity sales compared to last year, according to its UK half year financial results.

Many annuity providers have seen sales soar over the past year as annuity rates have climbed.

The provider said annuity sales in the half year were 100% up on the same period in 2022, breaking records.

New business sales for individual annuities at Canada Life UK were £441m in H1 2023, compared to £220m in the same period in 2022.

May 2023 saw over £100m in new pension business in one month, the highest sales figure since the Pension Freedoms of 2015.

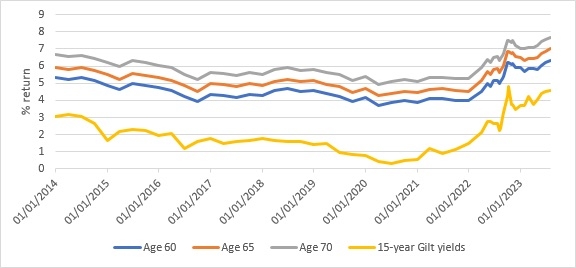

The company said its annuity sales increase was due to the significant rise in annuity rates over the past year and a backdrop of macroeconomic uncertainty driving demand from customers for guaranteed income products.

Lindsey Rix-Broom, CEO, Canada Life UK, said: “We’ve experienced an extraordinary comeback for individual annuities, driven by the significant increase in value offered from the returns available, combined with customers seeking income security in times of economic uncertainty. The record breaking performance of annuities has been a major driver of new business sales and the outlook for the second half of the year looks similarly very positive.

“We remain focussed on supporting our customers and communities during challenging economic times. The diversity of our business across wealth, retirement, group protection and asset management means we are well placed to meet the evolving needs of our customers and their advisers.”

A benchmark annuity for someone aged 65, with no pre-existing health or lifestyle conditions, would pay in the region of 7%, Canada Life said. This is based on a £100,000 purchase price, 10-year guarantee, no health or lifestyle factors. 15-year gilt yields sourced from ft.com.