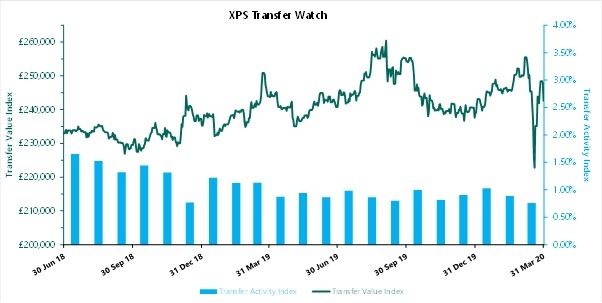

Defined benefit transfer values slumped by 3% in March and the number of members asking for a transfer value fell to a record low, according to figures released by the XPS Transfer Watch today.

XPS said the shock of Covid-19 fed through to transfer values and the numbers willing to consider transferring.

The XPS Transfer Watch monitors how market developments have affected transfer values as well as how many members are choosing to take a transfer.

The Transfer Value Index fell from £249,700 at the end of February, to £242,600 at the end of March.

The company said this “relatively small” fall was the result of gilt yields being at similar levels on the month ends but masked a turbulent month for transfer values.

In the week to 19 March the Index fell 11% to a low of £222,800, a level not seen since July 2016, before recovering to finish the month on £242,600.

The Transfer Activity Index recorded a sharp fall in the number of transfers completed in March, to an annual equivalent of 0.76% of eligible members, down from 0.89% in February, the lowest level recorded by the Transfer Activity Index since its inception in 2018.

The company added that warnings from the Pensions Regulator about transfer scams were particularly important at this time.

Mark Barlow, partner at XPS Pensions Group, said: “The unprecedented COVID-19 crisis has sent shockwaves through the financial markets, causing the greatest fluctuations we have ever seen in the Transfer Value Index.

“With such volatile markets, it is perhaps unsurprising that transfer activity has also fallen, to the lowest level since the inception of the Index, as members shy away from big financial decisions in the current climate.

“We welcome the regulator’s guidance on transfers as it provides comfort to those trustees looking to pause and take stock. However, we have found that around 75% of our clients are still able to continue quoting and paying DB pension transfers. In these cases, member support services such as scam protection and high quality financial advice, will be crucial in protecting member outcomes in the current environment.”

XPS Pensions Group’s Transfer Value Index shows the estimated Cash Transfer Value of a 64-year-old member with a pension of £10,000 a year with typical inflation increases. The value changes over time with market movements. Mortality assumptions are reviewed periodically.

XPS Pensions Group’s Transfer Activity Index, (the bars on the chart) represents the annualised proportion of members that transfer out of pension schemes administered by XPS. If replicated across all private sector, funded, UK, DB schemes this indicates that approximately 50,000 DB members leave their schemes each year.