The low-cost of exchange traded funds (ETFs) is the most important factor for investors, according to Morningstar.

The firm's fifth ETF survey found 91 per cent of ETF investors cited cost as a 'very important' or 'important' factor for them.

Some 94 per cent said the cost was the main reason they would recommend ETFs to other investors.

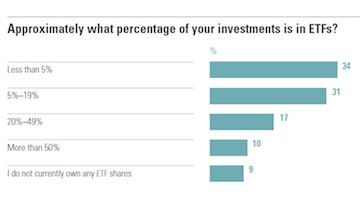

However, the majority of respondents said they held less than 20 per cent of their portfolio in ETFs. Some 10 per cent of individual investors and eight per cent of professional investors held over half their portfolio in ETFs.

The most-commonly held ETFs were country-specific equities, traditional broad equity indices and sector-specific equities.

Respondents were most aware of iShares, Vanguard and dbX-trackers as ETF providers and said they had heard of them via newspapers and magazines or online.

{desktop}{/desktop}{mobile}{/mobile}

The most important factors for respondents when considering an ETF provider were price of funds and liquidity of funds. These were both cited as 'very important' by 73 per cent of respondents.

Those respondents who did not invest in ETFs said they wanted more information first or preferred an actively-managed fund.

Hortense Bioy, director of European passive fund research at Morningstar, said: "In a world of low expected returns in all asset classes, it comes as no surprise to see greater focus on costs, and costs associated with ETF investing are no exception. The RDR and entrance of ultra-competitive providers like Vanguard in the ETF marketplace, have clearly contributed to further raising the UK investors' awareness of the low cost nature of ETFs.

"There is however still a need for education, especially among those prospective ETF investors."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.