The end of 2023 saw the rate of people transferring out of their DB pension fall to a five-year low, research from pensions consultancy XPS Pensions Group found.

Its Transfer Activity Index saw a steady downward trend across the year.

At the end of December, the tracker registered an annualised rate of 18 members in every 1,000 transferring their benefits to alternative arrangements, a new index low.

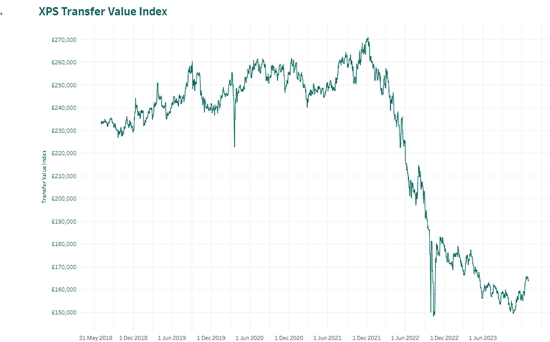

The continued fall in transfer activity was despite an end-of-year bounce in transfer values from October’s record month end low.

The index showed that the quoted value of a typical pension transfer increased by more than 5% in December, and by 6.5% over the last quarter of 2023 to £164,000.

That was mainly because of the fall in gilt yields over the last few months of the year. December marked the first time the index has seen two consecutive month-end increases since late 2021.

Mark Barlow, head of member options, XPS Pensions Group, said: “Despite transfer volumes hitting record lows, our research highlights that transferring as part of wider retirement planning remains a popular option for those aged over 55.

“Given that, it’s important that schemes provide support to members to help them make appropriate decisions for their circumstances. We are particularly concerned that a rise in smaller transfer values may put more of the most vulnerable members at risk of being scammed, as they are not required to take financial advice.”

He said that schemes should consider how they can best support members as they begin to access their pension pots.

He said that nine out of 10 of cases reviewed by the XPS Scam Protection Service in December raised at least one scam warning flag. The Scam Flag Index has remained high throughout 2023, although a slight dip in the second half of the year may have been down to more members transferring to purchase an annuity, which has a lower risk of scam activity.

Meanwhile the consultancy’s annual member outcomes survey found that transferring out of a DB scheme remained a popular option among over 55s despite falling transfer values.

It also found that there was a continued increase in the rate of smaller pension pots being transferred, with 40% of transfer values being under £100,000 and one in six falling under the £30,000 threshold that means members are required to take independent financial advice.

Earlier this month industry fintech Origo reported that the number of defined contribution pension transfers in 2023 soared by 22% to 1.2m despite predictions of a decline in the market.