The popularity of ESG investing is declining according to the annual ESG Attitudes Tracker from the Association of Investment Companies.

However a majority of private investors (53%) still say they consider ESG factors when investing.

But that is a notable fall from the 65% of investors who said they considered ESG when investing in 2021 and down from last year’s 60%.

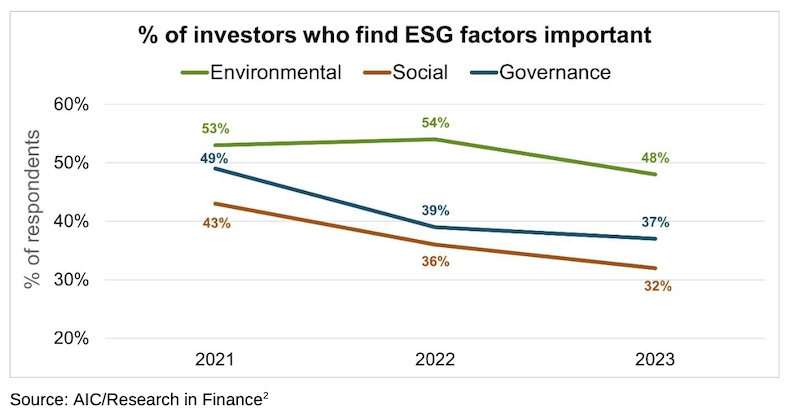

All three elements of ESG – environmental, social and governance – have declined in importance since last year, with environmental factors remaining the most important to private investors, according to the study by Research in Finance.

Among the 47% of investors who do not consider ESG factors when investing, the top reason given is that these investors prioritise performance over ESG issues.

That echoes similar survey results published in May by investment provider Charles Schwab which showed that 67% of UK investors said they prioritised returns over sustainable issues, up from 2021 when 55% said they prioritised ESG investments.

In the latest AIC report, not being convinced by ESG claims from asset managers came a close second to prioritising performance.

A majority of all respondents (63%) say they are concerned about greenwashing, and it appears these fears have grown.

In the 2021 survey, 48% of respondents agreed with the statement “I’m not convinced by ESG claims from funds”. That rose to 58% in 2022 and hit 63% in this year’s survey, showing that the investment industry has a long way to go before investors trust what they are being told about ESG.

Richard Stone, chief executive of the AIC, said: “Our ESG Attitudes Tracker suggests that 2021 may have been a high point for enthusiasm about ESG investing. There is plenty of residual support for the concept, but concerns about greenwashing are increasingly dominating private investors’ mindsets.

“These findings underline the importance of the regulator getting disclosure rules right, in particular the new labelling regime. A new regime with high standards that investors can rely on is essential for helping investors who care about ESG find products that align with their values and beliefs.”