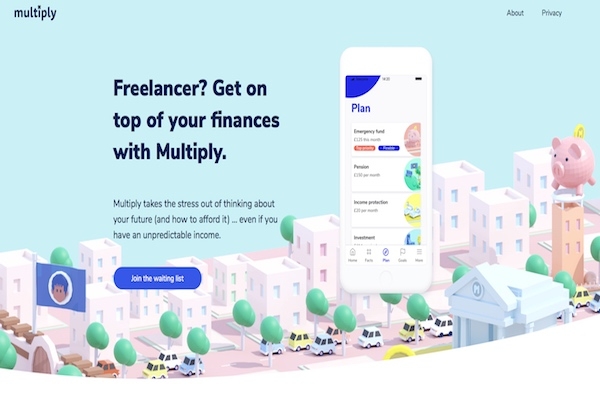

A fintech firm has launched what it claims is the UK’s first “free and independent Financial Planning app for freelancers and self-employed people.”

The app, which will be launched by Multiply this month, was said to provide self-employed people with “a simple way to get on top of their finances and plan for the future.”

The UK has seen a surge in flexible working, and significant growth of the gig economy in recent years, with 4.8m people now working for themselves.

But millions are denied access to the financial perks of full time employment, including saving on a predictable income, automatic pension contributions, and life insurance.

Multiply says a lack of relevant products, the high cost of advice, and confusing industry jargon meant many self-employed people struggle to get the financial help they need.

The innovation is currently in the FCA’s sandbox and is seeking full registration with the regulator.

Vivek Madlani, co-founder and CEO of Multiply, said, “We want to help independent workers enjoy the freedom they value, whilst also gaining the stability they deserve.

“The financial perks enjoyed by those in full-time work just don’t exist for this group.

“But building up an emergency fund, preparing for retirement and saving for life goals such as buying a home are just as, if not more, important when you’re working independently.”

The firm says its smart technology creates “a simple, made to measure plan based on affordability not earnings, to allow for the unpredictable income that comes with being self-employed.”

Multiply then continuously tracks and evaluates the financial products market to adapt users’ Financial Plans if a new product or rate rise alters the best course of action for them.

The free Multiply app will be available on iOS this month.