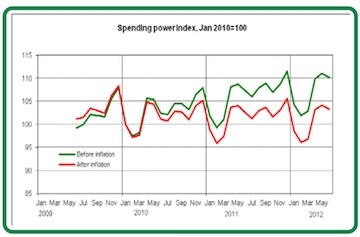

The firm's latest Spending Power report found spending was 0.7 per cent higher after inflation than last June, the equivalent of an extra £80 a year for consumers.

CPI inflation fell from 2.8 per cent to 2.4 per cent in June, according to latest figures from the Office of National Statistics.

Despite the falls, 75 per cent of consumers said they were concerned about inflation while 90 per cent thought the country's financial situation was not good.

Half of all consumers said they had more money to meet outgoings with money left over, up six per cent, while people aged 35-64 were most likely to spend it all.

However, income growth remained weak at 2.8 per cent year on year.

Patrick Foley, chief economist at Lloyds TSB, said: "Finally consumers are starting to see some of the benefits of lower inflation. It has taken a while but the fall in inflation has fed through to spending on essentials.

"Although spending power is heading in the right direction it remains far from healthy, in particular because income growth remains weak."

• Want to receive a free weekly summary of the best news stories from our website? Just go to the homepage and submit your name and email

address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.