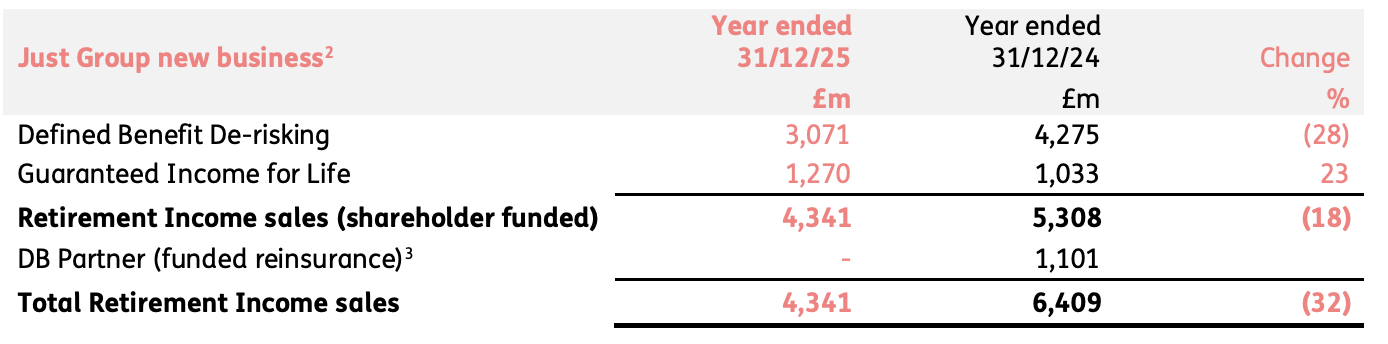

Retirement specialist Just Group reported that retirement income sales slumped 18% to £4.3bn last year while DB sales fell 28% to £3.1bn.

It revealed the figures today in a business update.

David Richardson, group chief executive at Just, said: “The proposed combination with BWS will be a great outcome for customers, shareholders and our colleagues. It reflects the strength of the Just platform and the long-term value of the strategy we have developed.”

The firm said it completed a record 130 DB transactions during 2025, although a relative lack of large deals led to the DB sales fall. It said that during the year, Just wrote five transactions above £100m, with the largest being £270m. That compared to nine transactions above £100m in 2024 with the largest at £1.8bn.

Just said the fall “was a consequence of market uncertainty during the first half of the year ahead of publication of the Pensions Bill in June. Following publication, there were around £30bn of transactions in H2 25 vs £10bn in H1 25.”

It said overall market activity continues to increase with around 350 transactions completed in 2025, a new record. In 2024 there were 300 transactions.

It said it expects an increased DB market opportunity in 2026.

Source: Just Group plc business update for the year ended 31 December 2025.

Just Group’s new business margin dropped to 6% in 2025, down from 8.7% in 2024. The firm said the decline was down toto tightening credit spreads, changes in business mix, and rising competition.

Mr Richardson said: “During 2025, our proactive approach to managing our capital resources, pricing discipline and risk selection meant that we sacrificed volume in what was an increasingly competitive trading environment, combined with tightening credit spreads. This dynamic led to a fall in new business margin.”