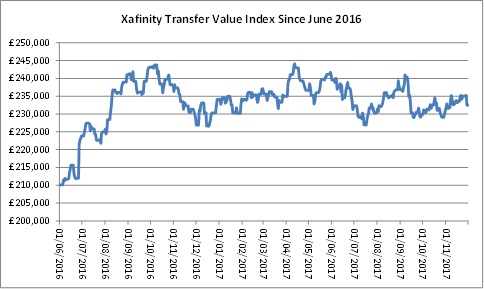

Pension transfer values remain stable during November, figures showed today.

From the end of October to the end of November the Xafinity Transfer Value Index was £232,000 at the start of the month and returned to £232,000 at the end of the month.

Over November there was a £3,000 (3%) difference between the maximum and minimum readings of the Xafinity Transfer Value Index.

The Xafinity Transfer Value Index tracks the transfer value that would be provided by an example DB scheme to a member aged 64 currently entitled to receive an annual pension of £10,000, increasing each year with inflation.

Sankar Mahalingham, head of DB growth, Xafinity said: “Transfer values remained very stable during November 2017, continuing the trend we have seen since mid-September 2017.

“As we stated last month, the rise in the Bank of England Official Bank Rate in early November, which was the first for over 10 years, was widely anticipated by markets and did not result in a reduction in transfer values in November. Another rise is anticipated by the end of 2018, another delay in a rise (which until very recently, has tended to be the case) would mean an increase in transfer values.”

The stable figures for 2017 come following a significant 15% rise in pension transfer values at the end of last year.

The Xafinity Transfer Value Index increased from around £203,000 at 31 December 2015 to just over £234,000 as at 31 December 2016.

Pension transfer values hit a record high in September 2016 and pension providers warned that growing transfer values could spur a growth in pension scams.