Artificial intelligence (AI) technology could proportionately cut the number of Paraplanners and admin staff working in the profession in future but lead to more Financial Planners being employed, the PFS Annual Conference heard today.

The predictions came in a session titled 'AI and How We Use It' from innovative Financial Planners Scott Millar, a Chartered Financial Planner, and Rob Schwarz, a Financial Planner.

Both are founders of new tech-based Financial Planning firm Finova Money which they set up using AI tools at the heart of their operation.

Both believe that AI could profoundly change the structure of the Financial Planning profession.

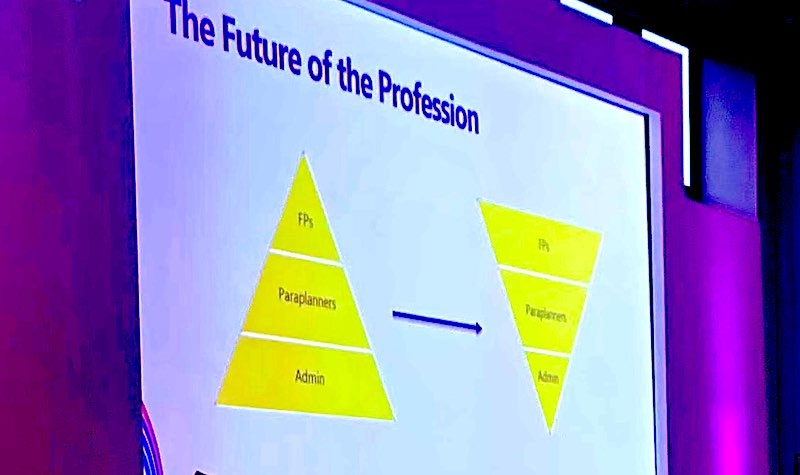

They believe the structure of the profession - with relatively few Financial Planners supported by many Paraplanners and admin staff - could be inverted in the future with the number of Financial Planners growing while numbers of Paraplanning and admin staff stagnating or falling as repetitive tasks became more automated via AI tools.

Mr Schwarz predicted that that AI would, "save time and reduce costs" for Financial Planners by cutting down on routine and repetitive tasks and automating admin. Cutting down on admin task would provide planners with more time with clients, he predicted.

He added that AI could also lead to better productivity and more opportunities for growth and development for all staff with some displaced Paraplanning and admin staff retrained and redeployed.

He said: "One question I'm often asked is: is AI going to replace us? And the answer is: I don't think so."

However, while there were many benefits with AI there were also risks, including data security, fraud and human bias in setting up the AI systems, he said.

The pair both said that AI and its use was now mainstream and not to understand it or harness it as a ‘companion’ in a Financial Planning business may mean missing out on its benefits.

Some of the key benefits of AI, they said, were: improving client outcomes, better engagement with clients, goal visualisation, business efficiency and content creation.

Both said that new AI tools coming along, including ChatGPT and apps such as Saturn, Answer the Public and Simplified, while still being developed, could offer major opportunities for Financial Planning firms.

The AI session took place at the 2023 National Conference of the Personal Finance Society taking place today at the prestigious new International Convention Centre near Newport, Wales.

Nearly 1,000 people attended the one-day event organised by the 40,000-member professional body for Chartered Financial Planners.

The theme of this year’s event is ‘Duty Bound - Loving Your Clients to Death’ and there were 15 sessions, with many focusing on client service.

The hashtag for the event is: #pfsdutybound