Financial Planning firms are reporting year on year growth in average client portfolio size and their firm's AUM, according to Financial Planning Today's annual survey of the profession.

Overall, the wealth-focused approach of firms surveyed by Financial Planning continues to be growing.

This year, average funds under advice or management at respondents’s firms rose to £840m (2024: £690m) with the average client portfolio size topping the half million mark at £516,000 (2024: £491,000).

This year there were almost double the number of firms advising on a typical client portfolio size of over £1m (7%) than there were in 2024 (4%).

The most common client portfolio size remained in the £251,000-£500,000 bracket, which accounted for 38% of firms, the same as last year. This was closely followed by the £100k-£250k bracket, with 32% of readers having a majority of clients in this portfolio area.

For a number of years we have asked readers to share the total value of their firm’s funds under advice or management. At the smaller end, this year 39% of firms had FUM of up to £50m and some 33% of firms said they managed between £51m and £200m of client money.

FUM at the larger firm level continued to hold steady. This year about one in five (19%) firms had FUM of at least £500m, similar to last year and 2023.

There continued to be a number of readers who said their firms had £5bn or more in funds under management with 12% of readers reporting this in comparison to only 6% last year and 2% in 2023.

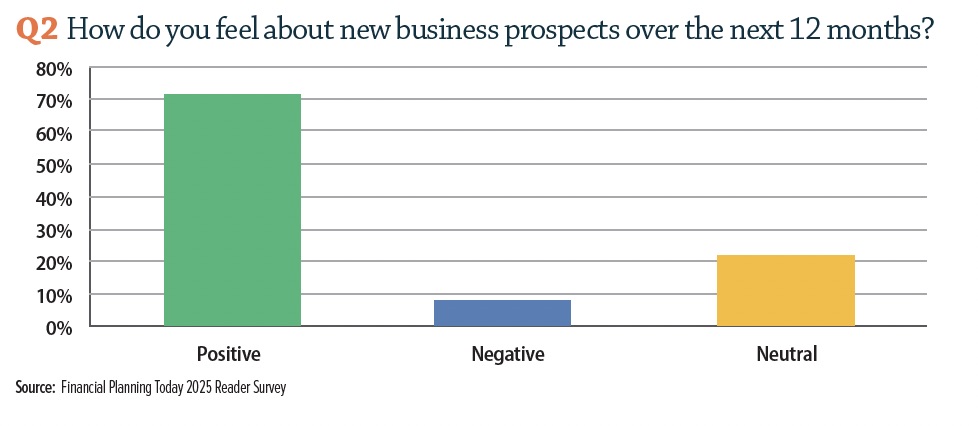

The survey revealed a good degree of optimism within the Financial Planning sector. This year almost three quarters (71%) of Financial Planners told us they felt positive about prospects for the profession, compared to 64% in 2024 and 45% in 2003.

Our readers saw modest growth in the number of clients they are advising. For the first time 23% of our readers have more than 2,000 clients served by their firms, the first time this segment has breached the 20% of readers barrier.

The 101-499 client bracket continues to be the most common number of clients for a firm, with 35% of our readers surveyed in this bracket. A total of 50% had less than 500 clients in total, this bracket holding steady since 2022.

There was a slight drop in the number of larger firms looking after more than 1,000 clients. In total 31% of Financial Planners work in firm with over 1,000 clients, compared to 32% last year.