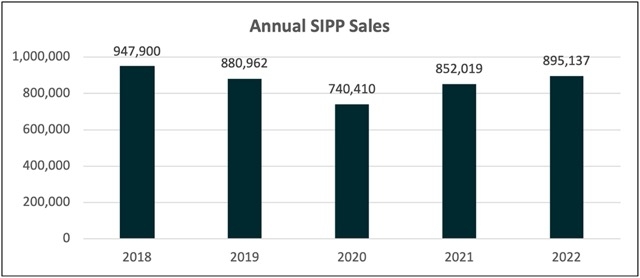

Sales of Self Invested Personal Pensions (SIPPs) bounced back in 2022 to reach nearly 900,000 new plans arranged - the highest level since 2018.

The figures suggest SIPP sales have recovered after dipping in 2020, with sales up for the second consecutive year.

Pensions consultancy Broadstone compiled the data from the latest FCA product sales figures.

The data revealed:

• After falling to 740,410 in 2020, sales of SIPPs increased by 15% to 852,019 in 2021 and then by a further 5% to reach 895,137 in 2022.

• Sales were the highest in 2022 since 2018 when 947,900 SIPP plans were sold.

• On a quarterly basis, Q1 2022 saw 240,903 SIPP sales – the highest level since Q4 2018 (240,940).

The FCA Product Sales Data also shows that the number of advised sales of personal pensions more generally has been rising, with non-advised sales showing less growth. Overall, non-advised sales have remained significantly higher than advised sales.

In Q4 2022 there were 213,049 advised sales of personal pensions compared to 160,902 in Q4 2021. In contrast, non-advised sales in Q4 2022 were 392,932 compared to 389,097 in Q4 2021.

Damon Hopkins, head of DC workplace savings at Broadstone, said: “For pension savers with the time and know-how to navigate the world of investments, SIPPs are a good way to exercise greater control over their pension.

“Greater engagement and participation in pension savings is ultimately what all industry stakeholders are aiming to achieve, so these examples of green shoots are encouraging. However, the challenge of achieving retirement adequacy through DC across the entire population remains a very significant one.”

• FCA Product Sales data – 2022: https://www.fca.org.uk/data/product-sales-data