Synaptic Software has launched its faster life assurance quotation and transaction service called Cover Me Now. The service went live on Friday 31 March with the aim of helping advisers speed up protection quotes.

The company, part of Capita, says that the Cover Me Now service is designed to provide a guaranteed insurance quote in minutes subject to a simple new ‘yes/no’ medical questionnaire.

It believes that making its life quotation service easier and quicker to use, and more flexible and mobile-friendly, will help advisers bridge some of the ‘protection gap’ by increasing the amount of protection business written.

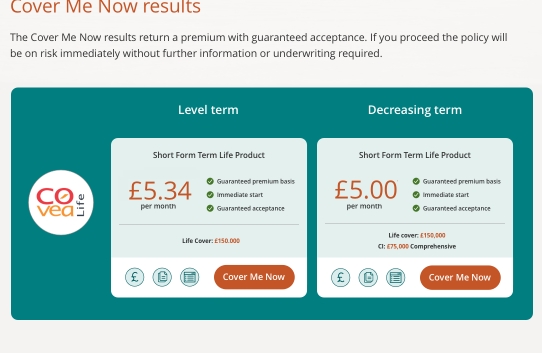

Cover Me Now asks 14 yes/no medical questions and if the client can answer no to all of them they will get a guaranteed term assurance quote, says Synaptic. The service will start with single life quotes with joint life and Critical Illness Cover added later.

The company’s existing Webline portal for quotes will still be available but advisers will need to register for the new service. The company issues up to 9 million life quotes per year and Webline will continue to power the new service.

Adam Byford, managing director of Synaptic Software, said that the company had launched the new service after undertaking a major review of its life insurance quotations system. It found that millions of quotes were being supplied but relatively few were moving to the transaction stage. Some customers were abandoning what they saw as an over-lengthy process.

Synaptic found that a protracted process to get a guaranteed quote - often involving further medical questions, lack of mobile interactivity and the fact more information was often needed – was holding back adviser take up.

Synaptic expects 70% of all life assurance requests via Cover Me Now to get a guaranteed quote. The rest will require further processing but the overall time to get a quote should be cut down significantly.

Mr Byford said: “Overall we are reducing the time it takes to get a quote and making the service more adviser-friendly. We hope that will go some way to bridging the protection gap.”

The company has been working with partner insurers and advisers to build the new service and take on board feedback.

Cover Me Now is an adviser platform but Synaptic also works with some consumer platforms for white-labelling such as Moneysupermarket.com and Cavendish Online.