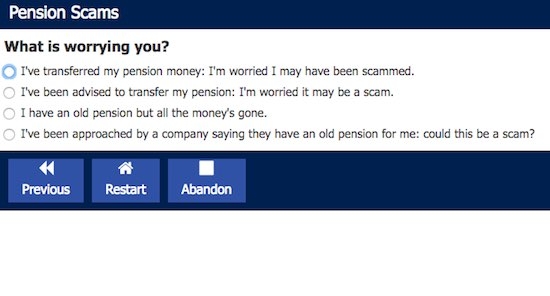

The Pension Advisory Service has launched an online pension scam guidance tool to help consumers and others spot pension cons.

The tool, and accompanying social media campaign launched today, will provide information about the warning signs consumers should look out for to protect themselves from scammers. The tool will also help those who believe they may be the victims or potential victims or scams but are too embarrassed to talk about their fears.

The campaign will include links to the tool, key messages and tips from 3 - 7 January. There will be information on these Twitter accounts too to help spread the message on social media: @TPASnews or the #protectyourpension and on Facebook.

The link to the new tool is here:

www.pensionsadvisoryservice.org.uk/my-pension/online-tools?moreInfo=4

More information about pension scams and where to go next is available at The Pension Regulator’s dedicated website: www.pension-scams.com .

TPAs says it has launched the online initiative because some consumers are being approached with clear examples of scams but other “offers” are more complex and harder for customers to identify it as a scam.

The organisation felt that it could do more by offering a “self-service option” giving information and guidance to those who may initially be too worried or embarrassed to “verbalise their concerns.”

TPAS says it also wanted to provide industry with a tool to which they can direct their savers, helping to disrupt the scammers throughout the process but especially at the point of a questionable transfer.

Michelle Cracknell, chief executive of the Pension Advisory Service, said “We are seeing positive signs that consumers are now more aware of pension scams, which is great news, but we must continue to offer consumers opportunities to learn about scams; how they work, the consequences and understand how they can best protect their pension savings.

“The tool we have launched today will go a way to helping those who may initially be too embarrassed or worried to ask for help. It will allow them to self-serve and be given next steps depending on their position, which includes talking to us.”

Lesley Titcomb, chief executive at The Pensions Regulator, said: “Scammers destroy lives so we welcome the launch by TPAS of the new online guidance tool to further help people.”

protect their retirement savings. We won’t let up in the fight against scammers and we continue to lead a taskforce of government, regulators, financial services bodies and criminal justice agencies (Project Bloom) to disrupt and prevent scams.”