New research has revealed just over half (55%) of wealth managers will survive if they do not digitally innovate.

The findings, from a survey by fintech firm Nucoro, revealed a potential 45% slump in wealth managers in 10 years’ time.

The study revealed wealth managers estimated that around 20% of their client-facing interaction is currently done digitally.

However, on average they expect to increase their investment in digitising their businesses by 27% between now and 2022.

In total, 43% intend to spend more in this area over the next three years.

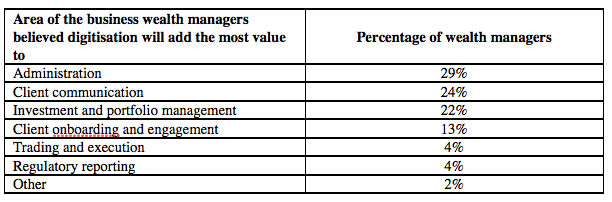

When looking at which areas of their operations wealth managers felt digitisation could add the greatest value, 29% cited administration, followed by 24% who said client communication.

One in five (22%) cited investment and portfolio management.

In terms of how wealth managers planned to improve their digital propositions, 57% were partnering – or are planning to partner – with specialist technology firms, while 22% intended to build in-house solutions.

However, 11% said they would sell their business to a company that was strong in this area and 9% planned to merge with another wealth manager that has an attractive digital proposition.

Some 7% revealed they intended to acquire a wealth manager with a strong digital offering.

Nikolai Hack, COO and UK managing director of Nucoro, said: “Digitisation is key to success in wealth management and our research shows organisations in the sector acknowledge this and are investing heavily in this area.

“However, the race to digitise will transform how the sector looks, with many companies falling by the wayside.

“There will be new entrants and a high degree of M&A activity.

“There is little doubt that the wealth management industry will look very different in 10 years’ time.”