Half (48%) of financial advisers expect the more relaxed regulatory framework brought about by Targeted Support to be an opportunity to attract new clients in the next 18 months, according to a new report.

Three quarters of financial advisers are looking to increase their assets under advice and grow their business organically under the FCA's new Targeted Support plans which will allow advisers and providers to give generic advice to groups of clients with the same characteristics.

Despite many advisers seeing opportunities, only one in 10 have a clearly defined strategy for doing so, according to a survey of 200 financial advisers by consultancy Nextwealth and Aegon.

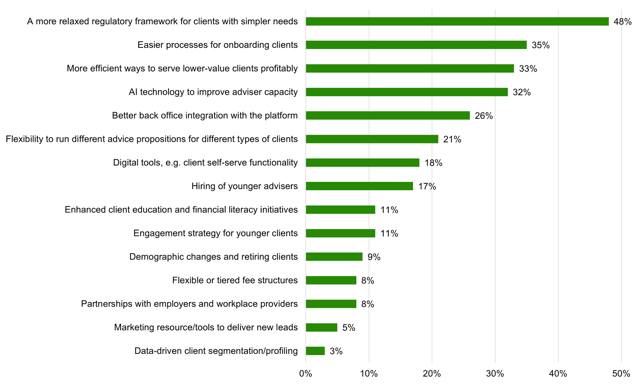

Other enablers of growth cited included an easier process for onboarding clients (35%), more efficient ways to serve lower-value clients profitably (33%) and the use of AI technology to improve adviser capacity (32%).

Chart: The most desired 'growth enablers' for financial advisers

Source: Organic Growth for Financial Advice Firms, Nextwealth, July 2025

Nearly half of the advisers surveyed were working with more clients than last year, but data from Nextwealth shows that just 14% of people with over £100,000 in investable assets are currently receiving ongoing advice.

In the UK there are 19.1m people with over £100,000 in investible assets with total assets of around £1,980bn. However, just £755bn of these assets are currently served by advisers (38% of total assets).

Stephen Crosbie, managing director of adviser platform at Aegon UK, said the UK adviser market was on the edge of a transformative moment.

He said: “With advancements in technology and a favourable regulatory environment, advisers can optimise their operations and processes to reduce friction and enhance client experiences.

“By supporting more individuals to make informed investment decisions, we harness the potential to drive substantial positive outcomes for everyone involved. This is a transformative moment for the industry, and those who adapt and innovate will be leading the way in shaping the future of financial advice.”

• Nextwealth surveyed 200 financial advisers in March, and in-depth interviews with 11 financial advice firms.