The latest data on pension transfers from pension firm XPS suggests a “significant increase” in the proportion showing signs of potential scam activity.

The XPS Transfer Watch suggests two in three pension transfers show signs of suspect activity.

The figures suggest that despite FCA crackdowns on poor quality pension transfers scammers are still targeting the large sums involved in transfers.

XPS says there was a “significant increase” in the proportion of transfer request cases processed in February recording at least one scam warning flag.

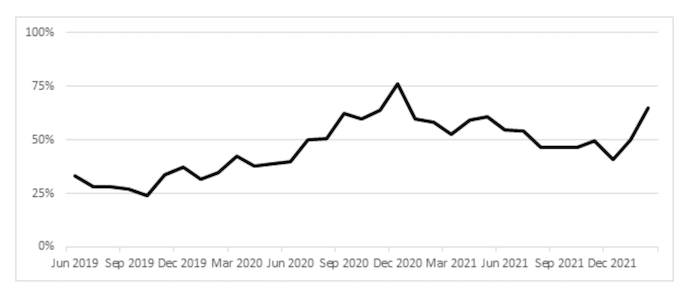

XPS Scam Flag Index

Source: XPS

Almost two out of every three potential transfers raised a warning sign, up from one in two last month.

However, transfer activity continues to decrease under pressure from regulatory action, with another record low number of members transferring.

The XPS Transfer Activity Index fell to an annualised rate of just 40 members out of every 10,000 transferring their pensions across the month, down from 47 in January.

XPS said that it has also seen the Transfer Value Index falling for the third consecutive month, registering a month-end average of £249,000, down 8% from its peak in November 2021.

The yield on gilts continued to tick up during the month, leading to a decrease in transfer values despite the rise in inflation expectations.

Helen Cavanagh, client lead, member engagement hub, XPS Pensions Group, said: “The new flags introduced last year by the Department of Work and Pension’s updated transfer regulations have driven a spike in transfer cases showing warning signs of pension scams.

“We expect this trend to continue over the coming weeks and months, which will put increased pressure on the Government’s MoneyHelper service to provide guidance to all these members.”

Mark Barlow, head of member options, XPS Pensions Group, said: “Whilst the recent slump in transfer activity shows no sign of abating, our indicative transfer value index has also recently been in decline. We expect that in the shorter term, markets are likely to endure another period of volatility given the current global conflict, which could also lead to an increased risk of wider scam activity.”

• The XPS Transfer Watch monitors how market developments affect transfer values for an example member, as well as how many members are choosing to take a transfer value. XPS Pensions Group’s Transfer Value Index shows the estimated Cash Transfer Value of a 64-year-old member with a pension of £10,000 a year with typical inflation increases. The value changes over time with market movements. Mortality assumptions are reviewed periodically.

XPS Pensions Group’s Transfer Activity Index represents the annualised proportion of members that transfer out of pension schemes administered by XPS. If replicated across all private sector, funded, UK, DB schemes this indicates that approximately 50,000 DB members leave their schemes each year

XPS Pensions Group’s Scam Flag Index tracks the percentage of monthly transfers reviewed by the businesses’ scam protection service that are identified as having warning ‘flags’ which indicate that the member is at risk of being scammed. The flags monitored include both the DWP’s set list of amber and red warnings and further areas of concern identified and monitored by XPS’ Scam Protection Service.