Trading in funds has risen by over a third (35%) in the past year, an online provider has reported, with recent stock market volatility encouraging significant sales of some large funds exposed to failing firms.

More investors have also switched out of the UK recently to Japan and Europe.

According to the latest figures from The Share Centre, based on its own customer data, there was a 35% rise in funds traded from January 2017 compared to January 2018. Share Centre customers have 265,000 share and ISA accounts.

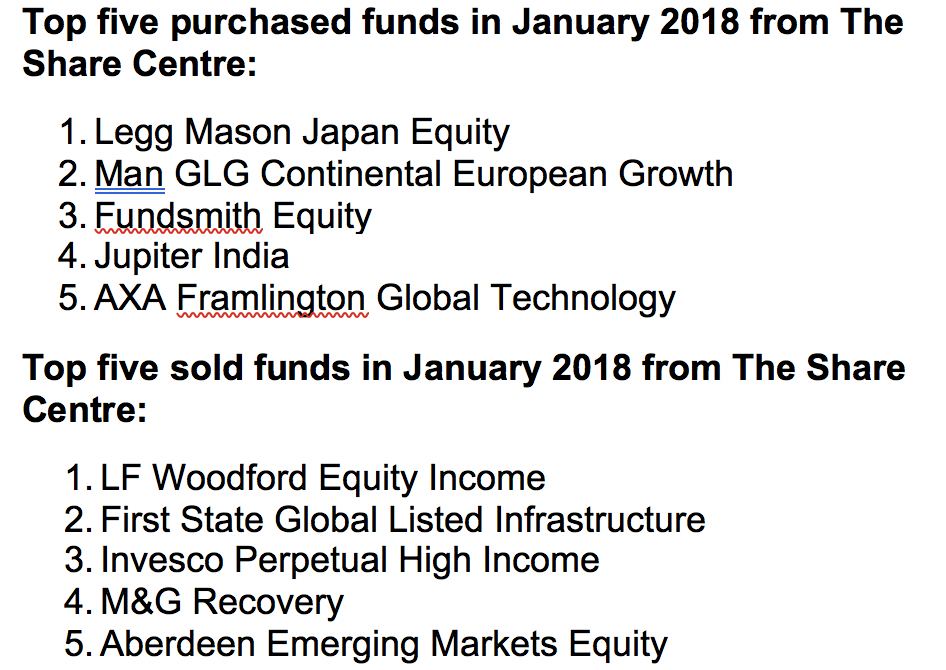

Looking at more recent figures for January, Legg Mason Japan Equity was the most bought fund in January while Woodford’s Equity Income fund was the most sold.

Source: The Share Centre

Sheridan Admans, investment manager at The Share Centre, said: “A 35% increase in funds traded from January 2017 compared to January 2018 is likely due to a rise in optimism among investors coming into a new year, perpetuated by rising stock markets supported recently by growth in corporate profits, an expanding US economy and tax reform policies.

A deeper analysis of investors trading in the first month of 2018 suggests investors are preferring to diversify their portfolios away from the long standing home bias of the UK.

He said: “Japan holds on to the top investment destination of choice for investors who may have taken some reassurance that Abenomics will continue as a result of the re-election of Shinzo Abe at the back end of last year. Meanwhile, the progress being made by the reformist pro-business government of India and the favourable outlook may explain the presence of the Jupiter India fund.

“Interest in the Man GLG Continental European Growth fund is unsurprising given that falling unemployment, improving policy reforms and reduced budget deficits across the continent are providing a positive backdrop for growth in Europe.

In recent weeks funds associated with infrastructure have been hit following the collapse of government contractor Carillion.

The Share Centre added that the presence of Neil Woodford’s Equity Income fund as well as the Invesco Perpetual High Income fund in the ‘most sold’ category could be related to their investments in Carillion as well as another government contractor Capita, whose shares fell 40% after it announced a restructuring programme.

The M&G Recovery fund has seen significant capital outflows in the last few years, as market conditions have favoured more growth and momentum led strategies.

The Aberdeen Emerging Markets Equity fund performance started to lag the IA Global Emerging Markets sector in mid-2017 and has struggled to catch back up.