Non-retired UK investors are saving a higher portion of their income for retirement than those in Europe, according to the annual Schroders Global Investors study.

The study surveyed more than 22,000 investors globally, including 1,100 in the UK, and found that UK investors were saving a higher proportion of their income for retirement (11.3%) than counterparts in Europe who were saving (9.9%). UK investors were saving closer to the global average of 11.4%.

The study found that 73% of UK investors felt that their retirement income would be sufficient when they retired but 42% of retired UK investors surveyed said they wished they had saved more for their retirement.

The survey found that to afford to live ‘comfortably’ in retirement the average investor thought they would need to save 12.4% of their income - more than their stated current actual saving rate.

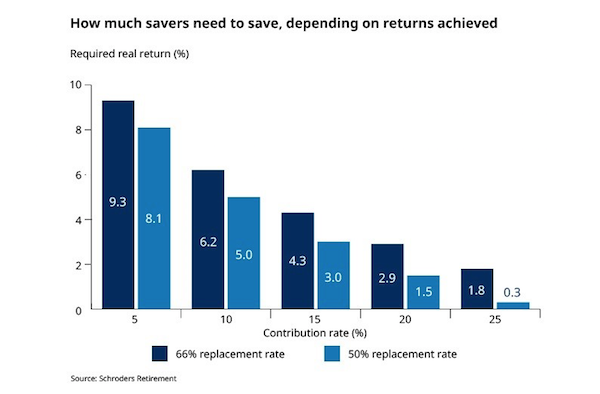

The chart below shows the analysis undertaken by Schroders. It assumes a starting age of 30 with a £35,000 salary that rises in line with inflation. It shows the real annual returns – where inflation is taken into account - that people would need to achieve two levels of income: 50% or 66% of salary when they retire. It also assumes they will draw on the money for 18 years, on average.

Overall, the study found that investors remained optimistic about the outlook for returns. In the UK, investors anticipated their investments would return 8.7% a year on average over the next five years. However, The Schroders Economics Group has forecast a 5.4% annual return for UK equities over the next seven years.

When it comes to retirement age the study found that UK investors would like to retire at just under 60 years of age. Once retired, the state pension will help fund their retirement but to a much lesser extent than other countries. the survey found.

On average, less than a fifth (16%) of UK investors’ retirement income is expected to come from the state pension compared with over a quarter (26%) in Europe and just under a fifth (19%) globally.

In the UK, a higher proportion of retirement income is expected to come from company pensions (30%) and other savings (17%) compared to state pensions.

Lesley-Ann Morgan, head of retirement at Schroders, said: “It’s well known that people aren’t saving enough for retirement but this study shows that even those who are already established investors are not putting away enough money.

“There’s also a strong message from some of those who have already saved: ‘I wish I had saved more’.

“The pension savings gap is further compounded by the fact we’re in an age of low rates and low returns. To reach their goals, people will need to save even more than savers did in previous generations.”