People retiring today are having to cope with a 46% drop in their pension income compared to 10 years ago before the credit crunch too effect.

A report by Fidelity found that those retiring now have suffered compared to their counterparts retiring a decade ago. On average, people retiring in 2007 earned wages which maintained their buying power, tracking 0.9 percentage points above Consumer Price Inflation (CPI). Consumers in 2017 experienced the opposite, with wage growth running at 1.7% against CPI of 2.7% - a full percentage point under inflation, effectively making them poorer, says Fidelity.

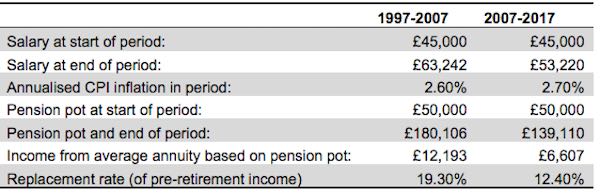

Lower earnings growth in 2017 has also hit pension contributions, with those retiring in 2017 paying in £5,179 less over 10 years compared to those investing in pensions 10 years ago.

The net effect is that people retiring in 2017 have a pension pot which is three quarters the size of those who retired before the credit crunch in 2008, according to Fidelity’s research. People retiring in 2017 have a pension pot of £139,110, while those who retired before the credit crunch had £180,106.

Fidelity says that this ‘hidden squeeze’ on pension incomes represents the combined effect of a real-terms fall in wages, lower market returns and greatly reduced returns on annuities.

Fidelity’s research modelled the outcomes of someone retiring today who in 2007, still had ten years of work and saving ahead of them. At the end of the period in 2017, their pension pot was used to buy an annuity at current market rates. The results were then compared to the outcome achieved had they experienced the conditions from the preceding 10-year period, from 1997 to 2007.

Ed Monk, associate director of personal investing for Fidelity, said: “This all makes grim reading for the 2017 cohort of retirees yet it’s important not to abandon hope. In the period since the crisis the pension freedoms reforms have freed many more people to access their pension pot using drawdown instead of an annuity.

“This comes with greater risk but at least provides an alternative to being locked into low paying annuities.”

For its research, Fidelity modelled calculations based on someone 10 years away from retirement in 2007 and 1997. Both scenarios earn £45,000 with a £50,000 pot of pension savings and contribute an ongoing 12% of their salary to a pension. Both scenarios are invested into a portfolio of shares and bonds (60/40 global equity, global bond. Salaries are uprated using an average from ONS Annual Survey of Hours and Earnings data and their pension contributions were added to their pot and invested. At the end of both periods (2007/2017) pension pots are used to buy an annuity at market rates of the time.