Fewer than four in ten pensionholders know the total value of their combined pension savings, research suggests.

Some 63% are unaware of how much their savings add up to and only 45% know what income this could generate in retirement, a YouGov survey found.

Even the majority of those approaching retirement are unaware with 49% of those aged 55 and over admitting to knowing the value of their pension pots.

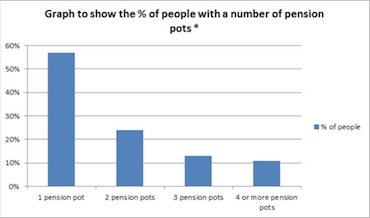

According to the research for Standard Life, more than two-fifths of pensionholders (43%) have two or more pensions.

Alistair Hardie, head of customer consolidation at Standard Life, said: "Many in Great Britain have multiple pension pots and very few actually know the total value of their savings and less than half of us understand what income this could equate to in retirement.

"Anyone aiming to retire before the state pension age should start paying attention to the value of their pension pots now in order to set appropriate and realistic goals.

"Having multiple pension pots and lots of statements to read through can make it more challenging for people to keep track of their expected income in retirement."

{desktop}{/desktop}{mobile}{/mobile}

Men are more likely to accumulate more pension pots – with one in four (24%) having three or more, compared to just over a tenth (13%) of women, the study found.

The Department for Work and Pensions reported earlier this year that UK adults work for an average of 11 employers during their career, which explains why many accumulate multiple pension pots.

Mr Hardie added: "One way to save time and keep things simple is to consolidate your pension pots, if it is the right option for you."