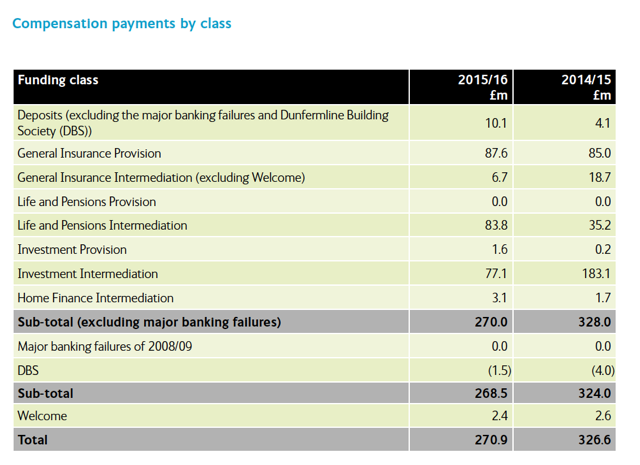

About £77m was paid out by to people with claims against financial advisers that later stopped trading in the last financial year, the FSCS revealed this morning.

The organisation also reported today that claims against the life and pensions advice sector led to a compensation bill of just less than £84m.

This was up from £35m the previous year.

It came as the average pay-out against advisers who recommended high-risk investments to hold in self-invested-personal pensions, increased year-on-year from £29,500 to £38,600, officials said.

The FSCS annual report, which published the figures, stated that it had responded to the failure of three investment firms, which had been placed into the Special Administration Regime during the course of the year.

This included paying £28.8m in relation to claims against Alpari (UK) Limited, £1.2m in relation to claims against LQD Markets (UK) Limited and £3.1m in relation to claims against Hume Capital Securities PLC.

The report stated: “These defaults highlight the need for FSCS to respond to sudden and unexpected firm failures quickly, returning client funds to customers through a streamlined payments process.

“In addition to dealing with continuing high volumes of investment claims in relation to advice to invest in non-standard asset classes, including unregulated collective investment schemes, FSCS began to see increasing numbers of claims concerning advice to participate in tax avoidance schemes linked to film partnerships or environmental plans.

“Although a relatively modest category of claim – with around 250 claims seen to date – the claims do present complex legal issues relating to the liability of financial advisers and quantification of losses. Decisions issued in the year found claims ineligible for compensation, but further claims remain outstanding.”

Almost £88m was paid to customers of firms providing general insurance – such as motor and employers’ liability insurance

Levies paid by the financial services industry to FSCS in 2015/16 totalled £1.09bn, compared with £1.08bn the previous year. Both figures include the interest cost and capital repayment levy for the banking failures in 2008/09, £454m and £697m respectively.