A survey has provided a picture of how the IFP's Accredited Financial Planning firms look compared to other adviser businesses.

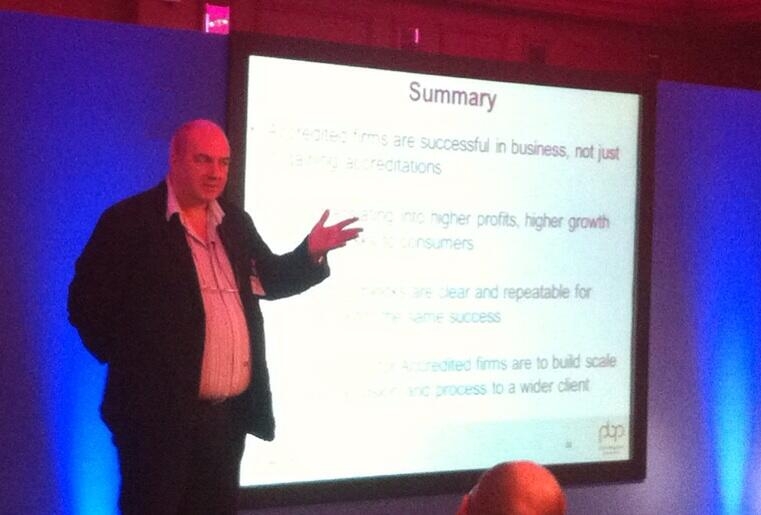

Phil Billingham, CFPCM revealed the findings of research at the Accredited Financial Planning Firms Conference on 6 March 2014.

Addressing the question of what makes Accredited Financial Planning Firms special he explained why Accredited Firms are market leaders in the Financial Planning sector.

{desktop}{/desktop}{mobile}{/mobile}

He said they create an aspirational standard for other planning firms to aim at. Mr Billingham said: "Accredited firms are successful in business, not just in gaining accreditations.

"This is translating into higher profits, higher growth and lower risk to consumers."

The survey yielded responses from 39 out of 67 Accredited Financial Planning Firms interviewed.

The study asked 'what do accredited firms look like?' and its headline findings were:

• Firms were predominantly independent businesses with two staff per planner

• Each has 60-80 clients – "It's a low number of active clients per planner"

• £82million assets under influence per firm

• £770,000 turnover last year per firm

• Mainly Finametrica users

• Mainly using passive investments

• Clear target clients

• Low cost of advice compared to many

• Higher profits than 'adviser' firms

• Lower risks within the firm and fewer complaints than average

• Efficient use of planners compared to many others – spending more time with clients

{desktop}{/desktop}{mobile}{/mobile}

The research also showed areas for improvement, which included marketing plans – "taking the vision outside the firm". There were a lot of firms who did not have a marketing plan, despite having a business plan. About a quarter said they do not have a written profile of their ideal client.

Aspiring firms can learn a number of things, according to Mr Billingham, including that a clear investment proposition is essential. He also listed independence, a clear target market and a robust risk analysis process as important.

However, he suggested there does not need to be radical change, saying: "We are a cottage industry but we don't have to keep on reinventing the wheel."

Briefly addressing RDR, he also said for many planning firms it was "a non-event, just a date in the diary".