Changes to the definition of financial advice will cut costs for firms, the Government claims.

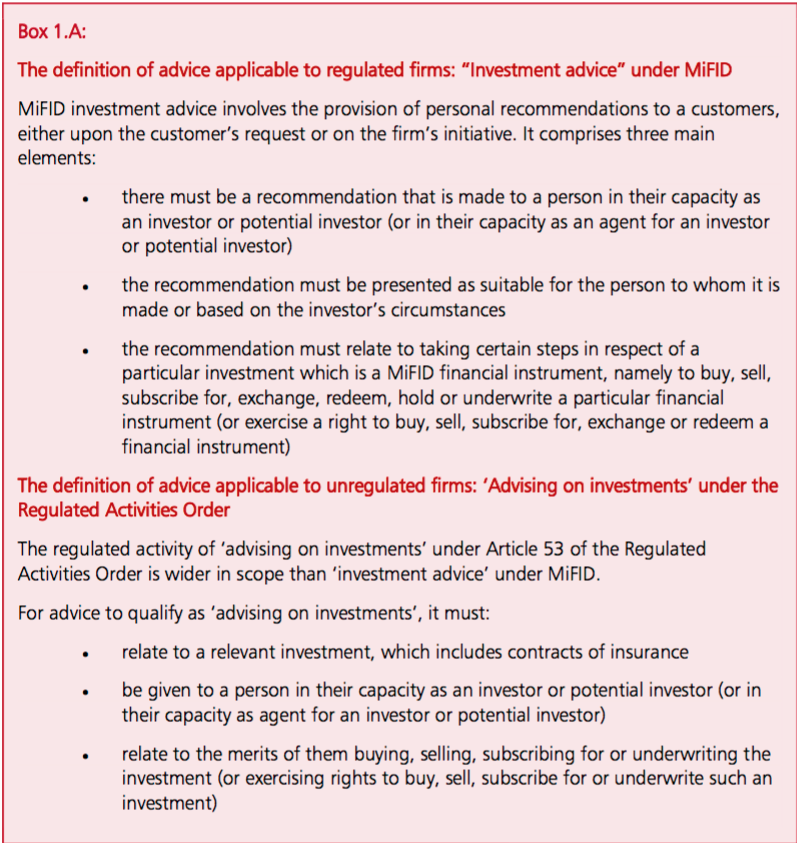

The new definition, bringing it in line with the Markets in Financial Instruments Directive, will come into effect on 3 January 2018.

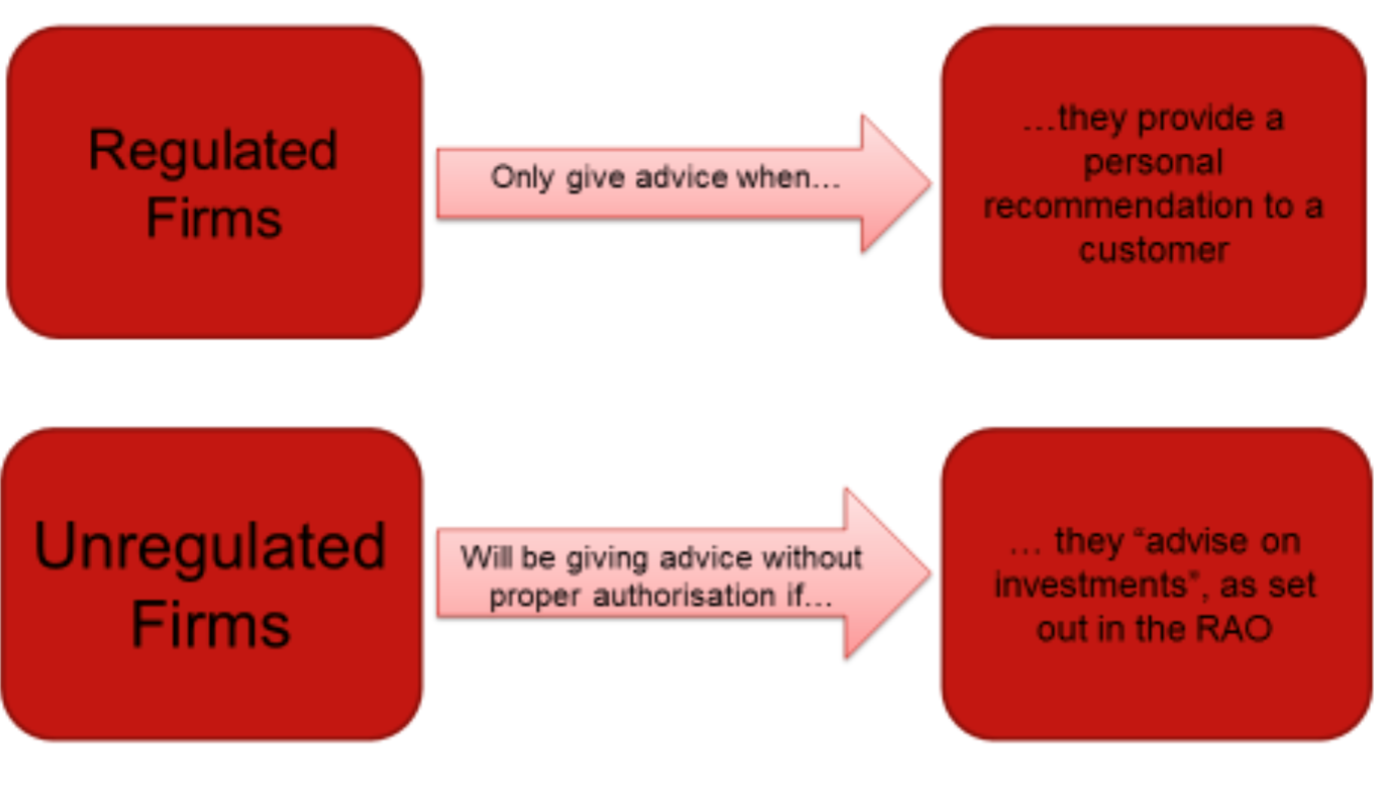

This would mean that only “advice which makes a personal recommendation” would be regulated.

Treasury officials, confirming the change late yesterday afternoon, said the majority of respondents agreed that the proposed definition was simpler for firms, and supported it.

They said there were financial benefits for businesses.

The first relates to savings from a reduction in the resources needed to avoid crossing the boundary from guidance to advice when offering help to consumers, the Treasury stated.

The changes set out in the paper included:

Source: Treasury

The Treasury papers stated: “Current uncertainty about the boundary means that firms often include a ‘second line of defence team’ to prevent a breach of current regulation. With a clearer distinction between the two activities, firms will be able to allocate less time and resource to their compliance mechanisms associated with the advice boundary.”

Views among respondents varied as to the extent of these benefits. They ranged from approximately £70,000 per annum to £4,400 per annum. Some firms stated that they did not expect to receive any monetary benefit.

The second main benefit related to opportunity cost, officials said.

The Treasury stated: “Due to the current uncertainty, firms are deliberately limiting their guidance services to remain well short of the regulated advice boundary. This creates an opportunity cost in terms of customers not served. After the change, firms will be able to give more tailored information and guidance to better serve customers. The vast majority of respondents to the consultation felt that this was the main, and a significant, benefit of the change. This opportunity cost is non-monetary and therefore non-quantifiable.”

The main costs for firms are “likely to arise from familiarising themselves with the change, for example by consulting with compliance experts, and potentially making small wording changes to documentation such as disclosure forms”, according to the document.

Respondents said that this would be a small to negligible one off cost - between £600 and £4,000 (for larger firms).

How the Treasury outlined the changes below: