Complaints against personal investments professionals, which includes tied and independent financial advisers and arranging intermediaries, rose from 27,525 to 34,886.

Some 34,382 of these cases have since been closed and 30,626 were closed within eight weeks.

The total amount of redress paid by advisers was £31m, up from £27m in the second half of 2011.

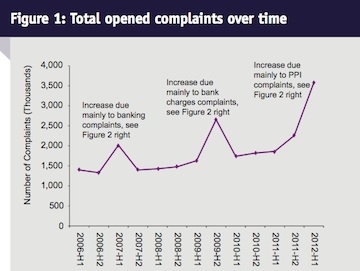

Total complaints about the financial services industry increased by 59 per cent to 3.58m, primarily driven by an increase in general insurance and pure protection complaints. The number of complaints upheld in this sector declined from 69 per cent to 63 per cent.

This group includes complaints about payment protection insurance which increased by 129 per cent, making up 62 per cent of total complaints.

Last week, Natalie Ceeney, chief executive of the Financial Ombudsman Service, spoke out about how FOS had also recorded a rise in insurance complaints.

She said: "We're concerned that we're now seeing more going wrong in insurance than we were a few years ago. And that when things are going wrong, they're not being put right sufficiently quickly or sufficiently well."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.