Two-fifths of self-employed people – 41% – are risking an uncertain retirement because they are failing to pay into a personal pension, according to new data from investment platform CMC Invest.

Almost half said they were not aware of SIPPs.

While employers must offer employees access to a workplace pension scheme by law, there are no similar requirements for self-employed people.

But self-employed workers who fail to set up a pension plan can easily find themselves financially vulnerable in later life, CMC warned.

The company surveyed more than 5,000 people, with more than half (58%) saying they were not aware of their pension fees.

Some 7% of those surveyed identified as self-employed. Almost half of them - 44% - said they were not aware of SIPPs, even though a SIPP could be the best solution for them.

Meanwhile, of the survey’s 282 homemakers and full-time parents, the lack of awareness was even greater, with 73% of them saying they did not know about SIPPs.

The data also showed that many people have multiple workplace pensions. Of the 3,592 respondents (71%) who said they had a pension, 40% admitted that they had not consolidated their pension pots into one account.

David Dyke, head of CMC Invest, said: “The statistics, while not surprising, are concerning. A pension is there to provide you with an income in the future. Without a pension, as people approach the age they’d like to ease up on work, they’re likely to be left short.

“With a SIPP it’s easy to start, stop and change pension contributions at any time, making it fit with the often-irregular income pattern of self-employed people.”

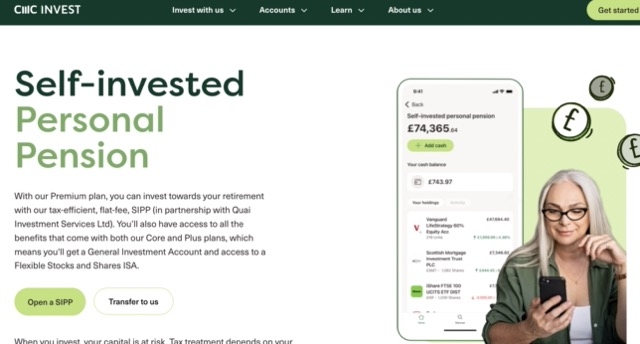

Earlier this month CMC launched a flat fee SIPP in partnership with Quai Investment Services.

CMC is a direct to consumer platform founded in 1989 in London. It is listed on the London Stock Exchange and is also the second largest stockbroker in Australia and has offices in 16 countries.

The survey of 5,078 people in the UK was conducted by CMC Invest with Censuswide.