The break-even point for retirees to get their money back from an annuity investment has fallen by five years as rates rise, according to Canada Life.

As a result annuities should be getting more popular, the annuity supplier predicted.

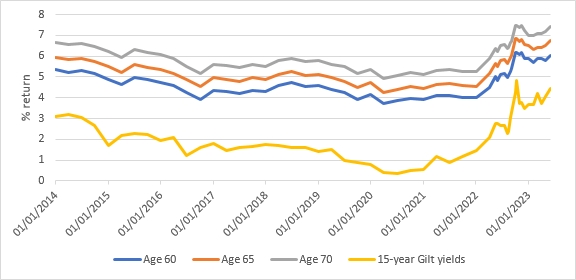

Its research suggests that the net result of the recent improvements in annuity rates means the payback period on a benchmark £100,000 annuity today is 14.5 years for a 65-year-old, which generates an income of £6,907 a year.

That compares to the same annuity paying an income of £5,240 five years ago, with a break-even point of 19 years, and the same annuity paying an income of £5,670 a year ago, with a pay-back period of 18 years.

Today, a benchmark annuity for someone aged 65, with no pre-existing health or lifestyle conditions, would pay in the region of 6.9%, Canada Life said.

It pointed out that annuity rates can increase significantly when people disclose common health or lifestyle conditions, such as diabetes, high blood pressure or being a smoker. Age can also have a big influence on the rate offered.

Nick Flynn, retirement income director at Canada Life, said: “It’s been a long time coming but annuities are firmly back in fashion, driven by the significant improvement in rates. This is evidenced by the break-even point, the tipping point at which you receive your original investment back through income.

“It has moved forward by nigh on five years, which shows just how much the market has moved in a relatively short space of time.”

He said annuity rates were currently at levels not seen since the banking crisis of 2008.

He added: “It’s difficult to predict where annuity rates will go, but markets have already priced in interest rate movements, while yields on gilts have stabilised.”