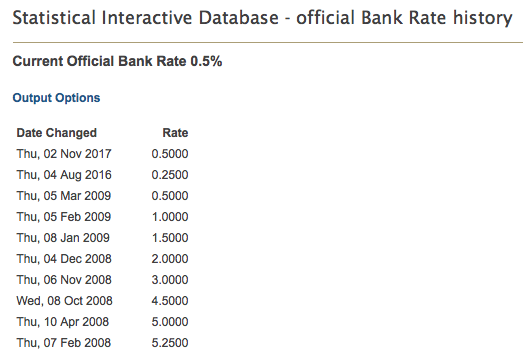

The Bank of England has today decided to raise the base rate from 0.5% to 0.75%, the highest it has been since 2009.

The increase was expected following narrowing margin of the vote, 6-3 from 7-2 against a rise the last time the Monetary Policy Committee (MPC) voted in June.

The nine members of the MPC voted unanimously to raise the rate to 0.75%.

A statement from the Bank of England read: "The MPC continues to recognise that the economic outlook could be influenced significantly by the response of households, businesses and financial markets to developments related to the process of EU withdrawal.

"The Committee judges that an increase in Bank Rate of 0.25 percentage points is warranted at this meeting.

"The Committee also judges that, were the economy to continue to develop broadly in line with its Inflation Report projections, an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to the 2% target at a conventional horizon.

"Any future increases in Bank Rate are likely to be at a gradual pace and to a limited extent."

There is still some way to go to match the heights of previous years with the rate standing at 5.25% just over 10 years ago and 17% in 1979.

(Source: Bank of England)

Philip Smeaton, chief investment officer at Sanlam UK, said: “Today Mark Carney and the MPC reluctantly raised rates by a quarter of a percent while house prices stagnate, businesses postpone investment and consumers think twice about using their credit cards.

“Continuing positive employment figures and wage growth help to justify today’s increase and the Bank will be hoping that the economy strengthens in the second half of the year.

“But with the clock ticking on a Brexit deal and nervousness on the high street, this optimism might be misplaced.”

Kevin Doran, chief investment officer at AJ Bell, said: “It feels like there is an element of the Bank of England reloading the interest rate gun in case we need an emergency Brexit related cut next year."

He added:“Whilst the increase is an improvement for savers, with inflation still being fuelled by a rising oil price and weak sterling it is little help for the vast swathes people whose purchasing power has been eroded by inflation comfortably outstripping the meagre interest earned on their savings."