Some 14.7m people are unsure when they will be able to retire, according to Barings Asset Management.

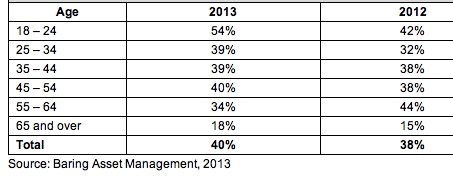

Research by the firm for its annual survey found 40 per cent of people were unsure when they would retire, up from 38 per cent in 2012.

Despite nearing the traditional retirement age, 34 per cent of 55-64 year olds, around 1.8 million people, said they did not know when they will be able to retire.

The average age that people planned to retire increased from 62 years old in 2009 to 64 years old in 2013. For people aged over 65, this increased further to 71 years old.

Some 5.1m people said they were not intending to retire at all, the highest figure since the Barings annual survey began in 2008.

Marino Valensise, chief investment officer at Barings, said: "It is clear that uncertainty is increasing for many people around retirement plans, with more people unable to say exactly when they plan to retire and the average age continuing to rise.

"Significant numbers of people nearing traditional retirement age reported they did not know when they will be able to retire and the worry is a lack of sufficient Financial Planning and pension provision combined with increased longevity is having a real impact on a large proportion of population."

{desktop}{/desktop}{mobile}{/mobile}

There has also been a substantial rise in the number of people aged 55-64 who have failed to save a pension. This had risen from 22 per cent in 2008 to 31 per cent in 2013.

The number of men without a pension has decreased from 30 per cent in 2008 to 26 per cent in 2013 but the number of women without a pension has increased to 42 per cent from 39 per cent.

Mr Valensise said the results were "alarming" and highlighted the need for effective retirement planning.

He said: "The fact that so many people say they do not have a pension, including relatively affluent people and those in the 55-64 age segment, underscores the need to focus on effective retirement planning. We are alarmed that so many people who should have proper plans in place do not, and urge everyone to better understand the benefits that they can get from planning ahead and starting early."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.