Fines worth up to £10,000 per day for auto-enrolment failures increased rapidly between January and March, with 96 being issued.

Up until this period, there had been just 31 Escalating Penalty Notices. The Pensions Regulator this morning revealed the big jump in the latest quarter.

The news comes soon after it was revealed that Swindon Town Football Club was fined £22,900 after it “repeatedly failed to comply” with auto-enrolment duties.

TPR warned employers today that they risk similarly large fines if they fail to meet requirements.

Depending on the size of the business, employers can be hit with Escalating Penalty Notices from £50 per day to £10,000.

The EPNs, one of the statutory powers TPR has, specify the date by which the employer must comply with certain actions or be subject to a fine which builds up at a daily rate.

The fine for small employers with 1 to 4 staff who fail to comply with an EPN is £50 per day and for those with 4 to 49 it is £500 per day.

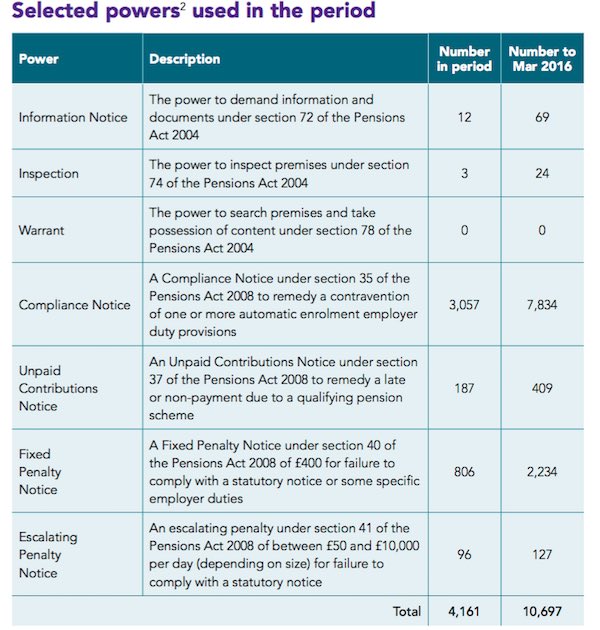

The regulator used its powers 4,161 times in total during this period. This included 3,057 compliance notices and 806 Fixed Penalty Notices.

Headline figures:

• 3,057 Compliance Notices issued, bringing total issued to date to 7,834.

• 806 Fixed Penalty Notices issued in first three months of 2016, bringing total issued since 2012 to 2,234.

• 96 Escalating Penalty Notices issued this quarter, bringing total issued to 127.

In one case, highlighted by TPR, an employer in the licensed restaurant sector was liable to pay a £400 fine because they failed to comply but because they engaged with TPR, further penalties were avoided.

Despite the large increase in Escalating Penalty Notices, overall, more than 95% of the first small employers required to put their staff into a workplace pension have now complied with the law, TPR reported.

Charles Counsell, Executive Director for automatic enrolment, said: “Most employers comply on time and we continue to see compliance rates in the high nineties. Others need a nudge and are prompted to meet their duties when one of our notices comes through their letterbox.

“It’s simply not fair for staff not to receive the pension contributions they are legally due. But failing to act also means an employer risks clocking up a significant penalty until they put things right.

“Our message remains that if things aren’t going well, then talk to us; don’t ignore us.”

Minister for Pensions, Baroness Ros Altmann, said: “Automatic enrolment is delivering fundamental change to workplace pension saving. So far over 100,000 employers have enrolled over 6 million workers.

“Levels of compliance amongst employers has been consistently high and I am pleased with all the steps The Pensions Regulator has put in place to support the huge number of smaller employers who have recently begun to undertake their duties.

“The aim of automatic enrolment is to get all employers setting up pension schemes for their staff. It is most encouraging to see that even the smaller employers are managing to do this, and the proportion facing enforcement action has stayed remarkably low.”