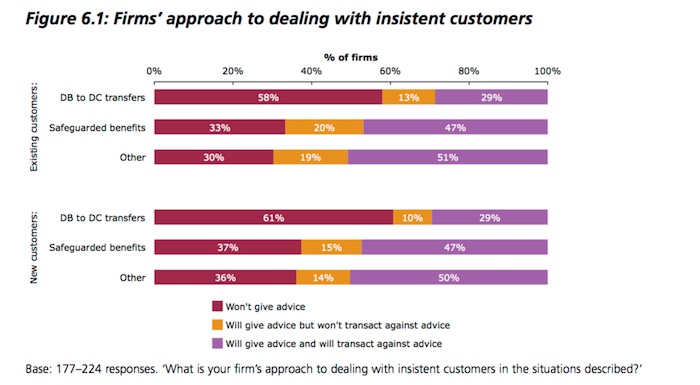

An FCA study involving 233 firms has shown that about half give retirement income advice to insistent clients and will transact against it in some situations.

A report, published today, found 50% will give advice to insistent clients and will transact against it to new customers in situations other than DB to DC transfers and safeguareded benefits. The figure was 51% for existing clients. See figure 6.1 below.

For safeguareded benefits the figure stood at 47% for both new and existing.

The survey found 29% of respondents would give advice and be prepared to transact against that advice for DB to DC transfers from new customers.

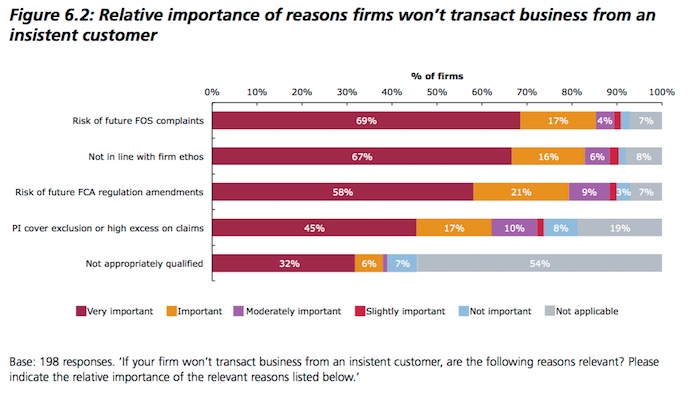

For those who would not transact with insistent customers, the risk of future Financial Ombudsman Service complaints was given as the most important reason for not transacting, with 69% of respondents rating this ‘very important’.

A slightly higher proportion of respondents said that they would not give advice to new insistent client customers compared to existing customers. This applied to advice on DB to DC transfers, safeguarded benefits, and other advice to insistent customers.

The results also showed:

• Where a customer was deemed to be insistent, 58% of firms would not give advice on DB to DC transfers to existing customers (61% for new customers).

• This was higher than the 33% who would not give advice on safeguarded benefits to existing customers (37% for new customers).

• On why firms would not transact business from an insistent customer, potential liabilities arising from future FOS complaints was seen as the most important reason, with 85% of respondents believing this to be ‘very important’ or ‘important’.

• Inconsistency with the firm’s ethos and risk of future FCA regulation amendments were the other two most important reasons, rated as ‘very important’ or ‘important’ by 83% and 79% of respondents, respectively.

Firms’ responses to questions about requests they had received for DB to DC pension transfers indicated a more than threefold increase in enquiries from new customers for this type of business post-pension freedoms, relative to the pre-pension freedom levels. For new customers, since the pension freedoms, 10% of firms were receiving more than five requests per month, on average.

Some 57% of firms thought that unclear disclosure of safeguarded benefits or other important information in the existing provider’s documentation was a ‘very important’ challenge when asked about issues that advisers were facing from providers post-pension freedoms.