Investor confidence has rebounded from the Brexit blues, according to Hargreaves Lansdown, with a 19% jump having been recorded.

The firms said this morning that its Investor Confidence Index increased 19% since July’s reading, which was taken in the immediate aftermath of the EU referendum.

The August reading of 80 is, however, still below the pre-Brexit level of 92, and lower than the long term average of 101.

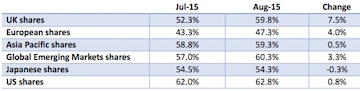

Outside of the UK, investor confidence in European shares also showed improvement, though sentiment is still modestly negative.

The US remained the market which investors have most confidence in, followed by global emerging markets.

Laith Khalaf, senior analyst at Hargreaves Lansdown, said: “Investors are now more positive about the prospects for the stockmarket than they were in the immediate aftermath of the referendum, though there is still a Brexit-shaped dent in confidence.

“The sharp fall and subsequent recovery in confidence underlines how volatile sentiment has been in the last few months, and why it’s a particularly inappropriate time to be hanging too much significance on one or two data points.

“This applies equally to consumer and business surveys too, and while it’s comforting to fill the Brexit information vacuum with whatever comes to hand, ultimately we’re just going to have to wait and see what the actual impact of the vote will be.”

He added: “When it comes to income, the UK stock market is pretty much the only game left in town, with cash on its back, bonds yielding next to nothing, and buy to let being taxed to the bone. Income-seekers investing in the stock market must accept fluctuations in prices and dividends however.”

Regional markets confidence scores - above 50% represents positive sentiment.