First Direct has found that many people have few or limited savings and many would fail to even last until the weekend if their money dried up.

A survey of 1,000 households revealed that 21 per cent of people have no savings at all and seven per cent have less than £250.

This number rises among those aged 25-34 with almost 40 per cent having less than £250 and 30 per cent having no savings at all.

Women were worse than men at saving with 24 per cent admitting to having no savings compared to 16 per cent of men.

The average household outgoings per month are £1,536 so it may be unsurprising that 32 per cent of people say they would be unable to cover their mortgage or rent if they lost their main source of income.

Averaging out at £50 per day, people with only £250 worth of savings would find they are only able to last five days.

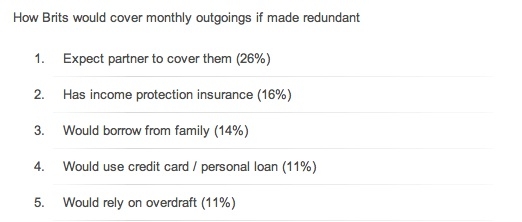

Family and friends were cited as important financial providers with 26 per cent of people expecting their partner to cover them while 14 per cent say they would borrow from family.

However, 11 per cent would use a personal loan or credit card to cover them and a further 11 per cent would use their overdraft facility.

Bruno Genovese, head of savings at First Direct, said: “These findings demonstrate a worrying lack of financial preparation among the British public. With the current climate of uncertainty, it is of utmost importance families are setting aside a realistic sum of money to be used in emergencies.”