Anticipated cuts to the pensions tax relief for people earning more than £150,000 are ‘perverse’, the Wealth Management Association claims.

The organisation has criticised the possible change, indicated in the Tory election manifesto, describing it as “anti-savings”.

George Osborne could be set to scale back the tax-free allowance by £1 for every £2 earned above that level.

The Chancellor will deliver the first Conservative majority government Budget in nearly 20 years from 12.30pm today. (See Financial Planner Online for live updates).

If the Government goes ahead, as expected, with the pensions tax relief reduction, the WMA said the hardest hit will be the professional classes – mainly in the south east - who are taxed under PAYE, rather than the very rich.

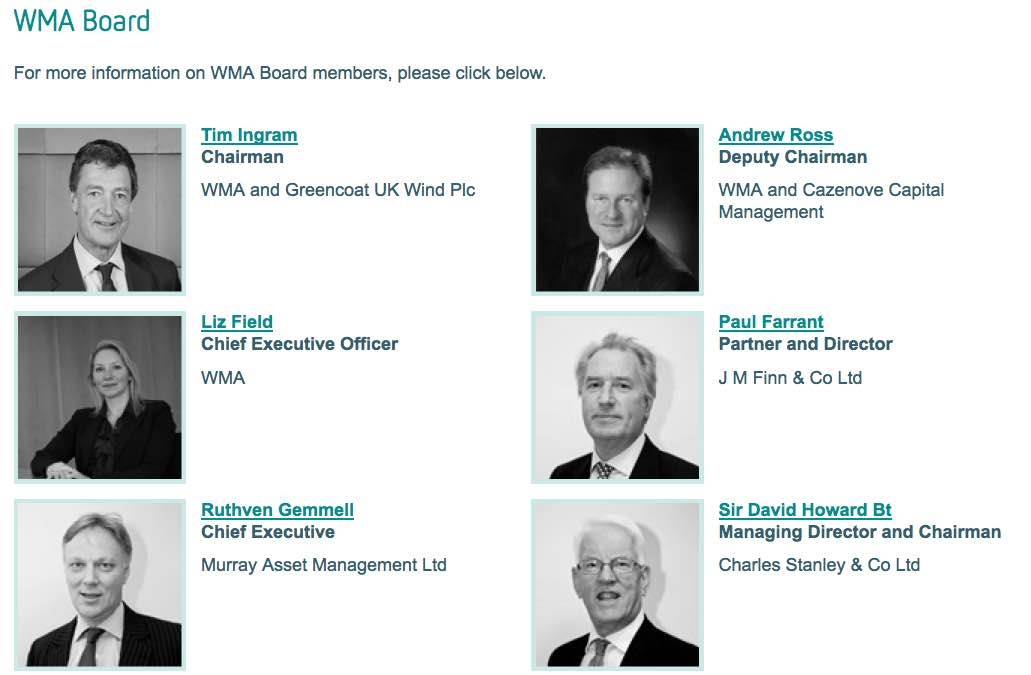

The trade association, representing 186 firms and associate members, said this group were “key savers, helping to fund wide ranging investments in growth projects”.

The WMA said it “seems perverse to impose an extra tax burden” on these savers considering what the pension reforms appeared to be aimed at achieving. The body said the focus should be a long term savings culture and labelled a tax relief cut a “contradictory policy approach”.

{desktop}{/desktop}{mobile}{/mobile}

Liz Field, chief executive of the WMA, said: “Cutting pensions tax relief sends an anti-saving message whatever guise it is in – whether a person earns £30,000 or £150,000, creeping taxation puts people off investing and saving for retirement and disincentives those saving less from trying to save more in case they get caught by taxes coming lower and lower down the scale.

“These changes come after the Chancellor’s ‘savings revolution’ in his last Budget just four months ago, and follow his widely publicised and promoted new pensions freedoms. Constant shifts in government treatment of these issues reduce trust in government initiatives and increase the public cynicism with which policy announcements are met.

“This is counterproductive to significant savings and investment objectives and undermines their impact on jobs, growth, infrastructure development and the ability of people to look after themselves in later life. The changes encourage people to spend their pension money, rather than keeping it for the long term.

“We need a long term government commitment to developing a full-scale savings and investment culture in the UK. With the reforms of recent years we thought we were heading in that direction. Today’s announcement cynically explodes that naive perception.”

Tom Stevenson, investment director at Fidelity, said: “After the positive changes to the retirement landscape in recent announcements, I expect any new initiatives to be less about increasing freedoms for pensioners and more about increasing revenues for the Treasury.

“With £35bn being spent by the Government on tax relief (80% going to higher rate tax-payers) and a further £15bn handed to companies in foregone national insurance on pension contributions, the incentive for the Chancellor to launch a raid on our retirement savings is too great to pass up, I suspect.”