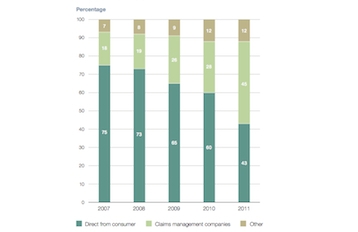

Claims management companies made up almost half of cases brought to the Financial Ombudsman Service (FOS) during 2011.

The FOS has been working with the National Audit Office over the last six months to assess the efficiency of the service.

The number of complaints received via claims companies has more than doubled since 2008 when they only accounted for 19 per cent. In 2011 they accounted for 45 per cent of complaints.

This growth has been due to the volume of mass claims regarding mortgage endowments and payment protection insurance.

Alongside bank and credit charges, these three issues have accounted for more than 50 per cent of FOS cases over the 10 years since it was established.

A key challenge for the FOS in 2012 will be handling these large surges of mass claims and how businesses deal with them.

Sir Christopher Kelly, chairman of Fos, said: “We’re currently consulting on how to gear up to be ready to deal with a further substantial increase in our workload next year as a result of the rising volume of PPI complaints and the impact of tough economic times on consumers and businesses alike.

“Faced with the challenge of resolving a quarter of a million cases next year- a ten-fold increase since we were set up in 2000 - we very much welcome the insight and rigour of this independent review.”

To read the report click here: http://www.financialombudsman.com/news/pdf/NAO-report-2012.pdf