Our democracies could use a dose of Life Planning.

In Life Planning we learn communication skills. Some advisers think of it as a way to build their businesses by reaching new markets, or to strengthen their business by retaining the clients that they have. All true. But it’s really about individual freedom.

Life Planning begins by listening to oneself, getting to know oneself, whether we are a consumer, an adviser or a politician. It involves finding one’s authenticity, one’s dream of freedom and then living it.

As an adviser (or as a politician or good friend) Life Planning involves listening to another, listening with empathy, listening with respect, listening with kindness, and most of all, listening with an unconditional positive regard for the other’s dream of freedom, helping them to articulate it or to discover it for themselves, without questioning, without doubt. After all it’s their dream of freedom, not ours. Life Planning asks us to believe in their dream of freedom and to dedicate ourselves professionally to deliver that freedom.

Here are some of the ways we learn to deliver these skills as advisers to clients in service of their dreams of freedom:

1. With emotional intelligence and authenticity we use empathy and pauses throughout our meetings and at any hint of emotion.

2. Identifying with the client and their dreams, we show excitement and great interest at the slightest hint of aspiration.

3. Life Planning becomes the center of all our meetings.

4. We practice crafting client goals into inspiring visions, so that the client is inspired by each meeting with us.

5. We attach financial architecture to the clients’ deepest and most profound aspirations so they experience the marriage of meaning and money.

6. We don't shy away from but embrace clients' concerns and aspirations, even if they are very personal, involving family or values or creativity or spirit.

7. In the first meeting we make sure the client talks 80% of the time.

8. We discuss financial matters only at the very end of the each meeting, so the client knows the financial process is all about them. It’s about their personal goals and their accomplishment first and foremost.

9. We deliver a life plan that energizes a client around all their money issues, because it is personal, meaningful and exciting to the client.

10. We aim for the delivery of the life plan's essence to start right away and to complete within a couple of years max.

11. We let the client know that the standard in our work is to Model Integrity and Deliver Freedom, and we show them how we do it. Clients want integrity from their advisers but they want freedom from their money. Without delivering both we will not win their trust.

What’s true in financial services is true in politics as well. The focus on listening, respect and the delivery of individual freedom is the proper one for both.

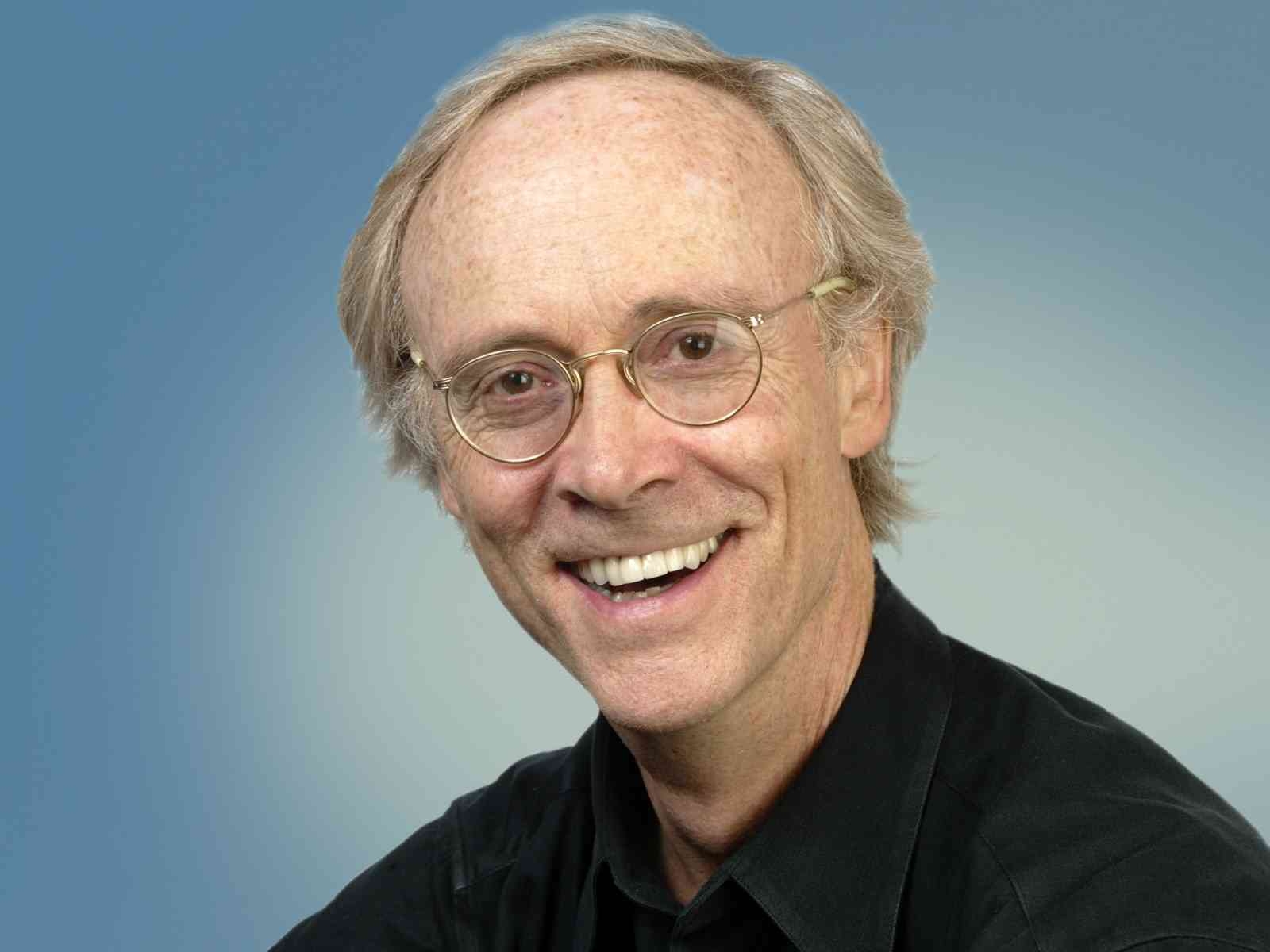

George Kinder, CFP®, Registered Life Planner®, author, is the founder of the Kinder Institute of Life Planning and recently launched the robo-adviser, LifePlanningforYou.com.