Cashflow modelling is extremely useful, but not essential to good Financial Planning. I’m in great agreement with Financial Planner Martin Bamford here.

Although too sensitive to inputs for long-term confidence, we have used cashflow modelling often to great effect for short and intermediate term decision making for moderately well to do clients. For many middle market and poorer clients it can smack of selling product to insist they pay for cashflow modelling.

If they are not already well aware of their budgetary, saving and investing requirements for their future, there are much simpler and less expensive tools such as BERT (Back of the Envelope Retirement Tool) that determine retirement savings required utilizing the 4% (or whatever figure you and the client deem best) withdrawal rate so much literature has been written about. (eg William Bengen, Wade Pfau, Michael Kitces, Jonathan Guyton etc).

What is essential for great Financial Planning?

But I’m getting ahead of myself here. I think most of us are. The question about cashflow modelling raises the larger question: what is essential for great Financial Planning?

I’ve purposely used great instead of good. Personally I’m not sure that good is good enough. Certainly to have all the skills of a Certified Financial Planner, along with the tools of cashflow modelling in your hip pocket is very helpful, although none of them individually, I think, are essential to a great Financial Planning engagement.

There are only two things that I think are essential to great Financial Planning. One involves our aim, and the other is the primary skill we use to deliver it.

Related articles

Readers' verdict: Cashflow essential to true Financial Planning

Our aims

If our aim is to put the client first, how can our aim be anything less than to deliver the client sitting in front of us into their dream of freedom in the most efficient way we can, using all the skills of Financial Planning that we have learned?

The most basic and most profound skill that we have (and most essential to Financial Planning) is our ability to listen. Sometimes just listening is all we need to do, with empathy, with kindness, with appreciation and with perhaps a moment of wisdom coming at the end of the meeting from the knowledge that we have accumulated as a Financial Planner as well as a human being.

Personally, when I do a financial plan, my passion is to maximize the amount of time the client’s life is filled with their passion and vitality, all within the constraints and the container that a client feels necessary for their financial security. But if we put their financial security first in our conversation, it’s like pouring a bucket of water over the torch of their dream of freedom. If our focus is not on the client’s freedom, but on the utilization of our skills, there will be an inevitable inefficiency and misallocation of resources both for the client and for ourselves. Not only that, but their family, their community and society will be robbed of their vigor.

Wider implications

The energy of freedom that Financial Planners alone can deliver to clients has profound implications for society. Financial planning should be right at the heart of economics here, stimulating all the innovation and entrepreneurial energy in the world as we deliver moments of freedom to our clients. Much more powerful than the entrepreneurial energy of capital markets is the power we bring to stimulate entrepreneurial energy through Financial Planning to all segments of society and to every culture within it. Cashflow modelling is a fine tool. It pales in comparison to what is essential in great Financial Planning.

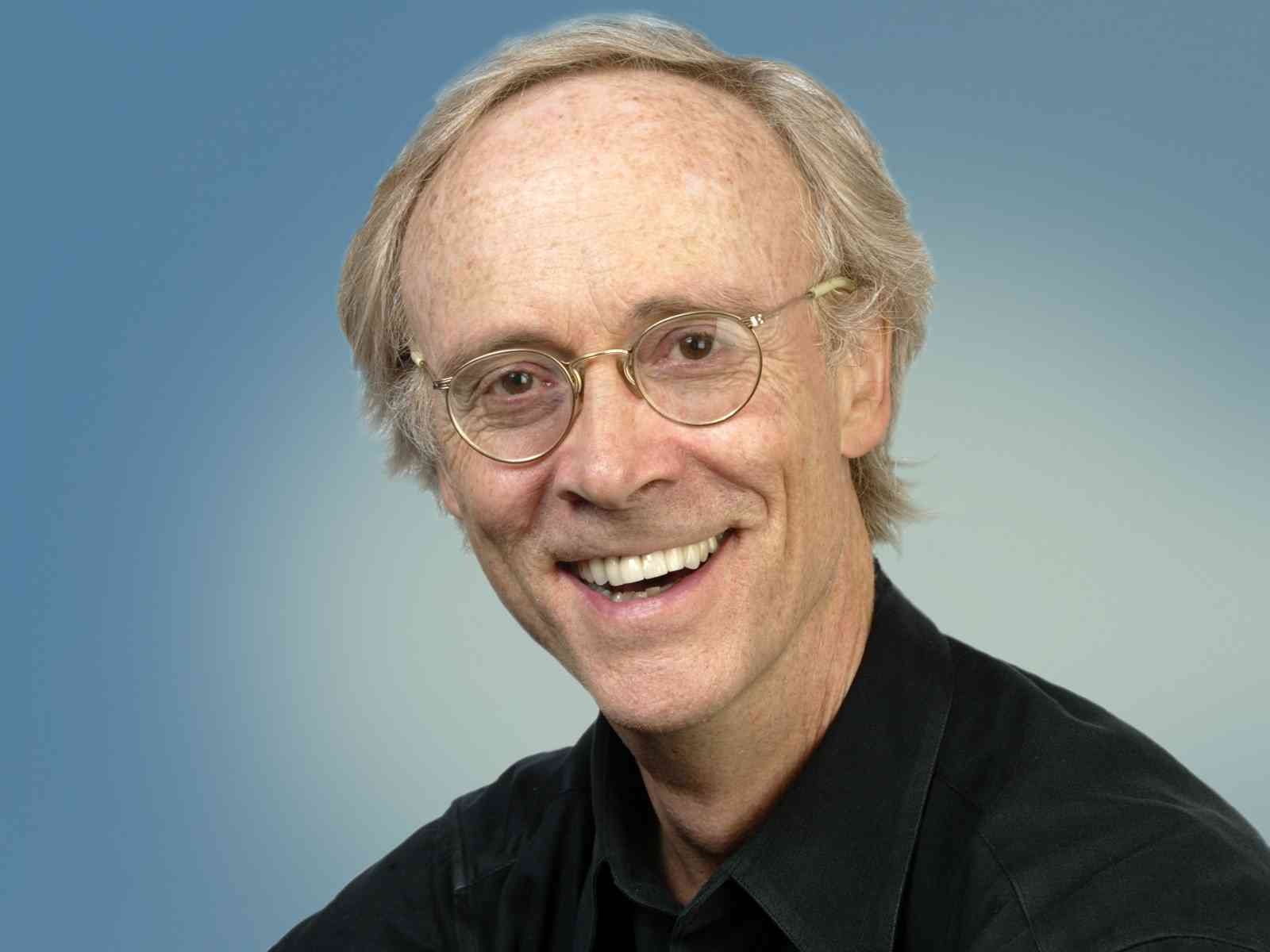

George Kinder, CFP®, Registered Life Planner®, author, is the founder of the Kinder Institute of Life Planning and recently launched the robo-adviser, LifePlanningforYou.com.