Some 61 per cent of people in their fear running out of money more than death, according to Allianz.

The firm surveyed over 3,000 American people aged 44-75 in its survey 'Reclaiming the Future'.

The figure was mentioned by David Blanchett at yesterday's Morningstar Investment Conference as a reason to encourage people to buy a pension or an annuity.

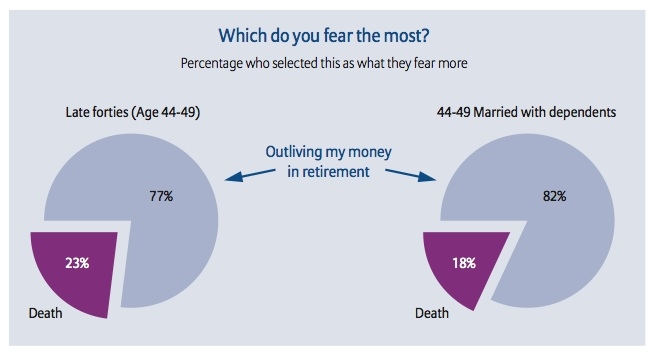

The amount increased to 77 per cent for those aged 44-49 and 82 per cent for those in their late 40s who had dependents.

Those in the lowest income category, with a household income of $30,000-$45,000 (£19,000-£29,000) were most worried about outliving assets.

{desktop}{/desktop}{mobile}{/mobile}

In order to ensure they held onto their money, American investors were now prioritising safety over returns. The top three most important factors were predictable standard of retirement living, guaranteed income for life and a guarantee not to lose value.

Some 69 per cent said they would prefer a product that was "guaranteed not to lose value" to a product aiming to provide high returns.

Over half wanted an annuity-like solution with moderate growth opportunities, guaranteed monthly income for life and limited access compared to a product with total access that could run out of money. This figure rose to 77 per cent among the mass affluent, with a household income of $100,000-$150,000 (£65,000-£98,000).

However, respondents disliked the word 'annuity' even if they said they wanted an annuity-style product. This was due to old opinions of annuities formed 10-20 years ago and lack of research on current products.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.