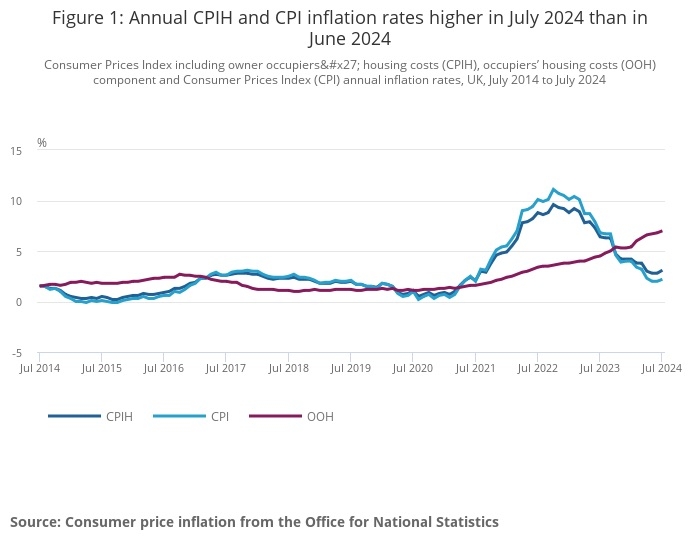

CPI inflation showed its first rise this year in July with a 0.2 percentage point increase to 2.2%, ONS reported today.

The Consumer Prices Index (CPI) for the 12 months to July was up from 2% in June, breaking a downward trend this year.

Upward pressure in inflation came from rising housing and household service costs and sharp falls in gas and electricity prices last year easing this year.

While CPI and CPIH have fallen in recent times there are signs that rising owner occupied housing costs are proving difficult to dampen.

The Consumer Prices Index, including owner occupiers' housing costs (CPIH), rose by 3.1% in the 12 months to July 2024, up from 2.8% in June 2024. On a monthly basis, CPIH was little changed in July, compared with a fall of 0.3% in July 2023.

On a monthly basis, CPI fell by 0.2% in July, compared with a fall of 0.4% in July 2023.

The largest downward contribution came from restaurants and hotels, where prices of hotels fell this year having risen last year.

Experts warned that the Bank of England will need to keep a close eye on inflation to maintain its 2% target.

Core CPIH (excluding energy, food, alcohol, and tobacco) rose by 4.1% in the 12 months to July, down from 4.2% in June. The CPIH goods annual rate rose from negative 1.4% to negative 0.5%, while the CPIH services annual rate fell from 6.0% to 5.7%.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.3% in the 12 months to July, down from 3.5% in June; the CPI goods annual rate rose from negative 1.4% to negative 0.6%, while the CPI services annual rate fell from 5.7% to 5.2%.

The older measure of inflation, RPI (Retail Prices Index), increased from 2.9% in June to 3.6% in July.

Nathaniel Casey, investment strategist at wealth manager Evelyn Partners, said rising housing costs were responsible for much of the increase in prices.

He said: "Despite headline inflation ticking back up above the Bank of England’s 2% target, unfavourable base effects where largely to blame, as a -0.4% monthly print from July 2023 fell out of the annual comparison. Both headline and core inflation undershot expectations in July with both measures coming in 0.1% lower than forecasters had been expecting.

"Within today’s data, the category for housing and household services, which includes energy, was responsible for nearly all this month’s acceleration in the annual rate. Despite the category remaining in deflationary territory, pricing pressures are easing at a slower rate than they where a year ago, causing the overall annual rate to accelerate."

Richard Carter, head of fixed interest research at investment manager Quilter Cheviot, said: “Today’s inflation data is a reminder for the Bank of England of the difficult task it has on its hands as inflation has risen again above the 2% target to 2.2% in July.

"One data point will not cause panic to spread, and much of this rise was expected due to favourable comparisons falling out of the figures. The good news is that these figures are slightly better than the market anticipated, which the BoE will be very pleased to see."

Scott Gardner, investment analyst at digital wealth manager Nutmeg, said: “After two months of headline inflation holding steady at the Bank of England’s 2% target, the slight increase in today’s headline CPI data might come as a surprise to some – but it shouldn’t cause alarm.

"Markets and commentators had widely expected that inflation would tick-up slightly in the second half of the year as policymakers try to strike the balance between keeping inflation under control and starting to cut interest rates that are squeezing household finances."

George Lagarias, chief economist at wealth and accountancy firm Forvis Mazars, said: “Inflation ticking up will probably not discourage the central bank from further rate cuts. Despite the uptick, all key measures, headline, producer prices and services inflation rose less than anticipated by markets.

"The global economy is evidently slowing, which means that price pressures should continue to subside. Having said that, even at a reduced pace, services inflation is still too high for comfort. The billion-pound question for policymakers is: can China maintain lower export process for goods long enough for Western services inflation to come down closer to its long-term averages?”

Ed Monk, associate director for personal investing at fund manager and platform Fidelity, said: “A rise in the headline rate of inflation today is less important than a slight easing in core inflation - down from 3.5% to 3.3% - which suggests the trajectory for price rises is still downwards. Easing wage rises reported yesterday point to a similar trend and suggest we remain on track for further cuts to interest rates in the months ahead.

“The expected level of interest rates has been falling, with one more cut in 2024 predicted and markets now expecting rates to dip below 4% towards the end of next year. Lower rates have tended to be positive news for stock markets, but investors should always be aware of the wider picture - rates are coming down because there is less momentum in the economy. The Bank of England has begun to ease monetary policy and will be watching growth data closely for signs of a more sudden slowdown that could accelerate the timetable for rate cuts.

“As rates fall cash will become less attractive. Many investors have sought the safety of cash deposits this year as rates have stuck above the rate of inflation, but they may be forced to reassess as interest rates falls. Bonds, which have disappointed for some time, may become more attractive if cuts come through more quickly.”