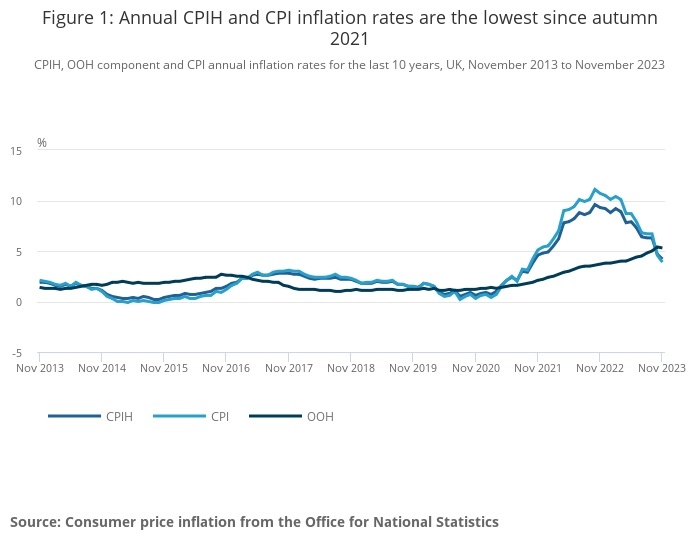

The CPI inflation rate dropped from 4.6% in October to 3.9% in November, continuing a rapid decline seen in recent months.

The 12 month CPI rate was 6.7% in September and 10.1% in March.

The move bolsters the Bank of England’s commitment to reduce CPI back to its target rate of 2%.

CPIH (the Consumer Prices Index including owner occupiers' housing costs) rose by 4.2% in the 12 months to November 2023, down from 4.7% in October.

The biggest downward downward contributions to the monthly change in both CPIH and CPI annual rates came from transport, recreation and culture, and food and non-alcoholic beverages. Petrol prices, for example, are now at a two year low. The fall in the rate of inflation will provide some relief to hard-pressed families although prices are still rising well above the long term inflation average.

The Retail Prices Index (RPI) 12 month rate also fell from 6.2% to 5.3%.

Reaction to the drop from industry experts was generally positive but some have pointed out that economic growth remains dismal.

Kirsty Watson, chief operating officer, at Abrdn adviser, said: “Prices are now rising at their slowest rate in more than two years, and significantly slower than the 10.1% CPI recorded at the start of 2023.

This will be welcomed by clients and advice firms alike – both have had to shoulder increased costs.

“As we look ahead to the new year, the big questions will be whether this trend will continue, what factors might spark further price rises and how interest rates are likely to respond to future movements. Clients will value reassurance that their financial plans are prepared to keep delivering good outcomes, whatever conditions transpire, and that their advisers are on hand to help them adapt their strategies quickly if and as required.”

Richard Carter, head of fixed interest research at Quilter Cheviot, was more sceptical.

He said: “Comparative to last year, there has recently been a sense of cautious optimism in the air and this morning’s inflation figure of 3.9% adds to this. The Bank of England now certainly faces a less daunting task in steering inflation back to its 2% target next year, without necessitating a deep recession.

“Despite today’s drop, the broader economic picture remains complex, marred by stagnation and subdued growth prospects. The year 2023 has been marked by economic inertia, a narrative underscored by the recent Office for National Statistics report, revealing a 0.3% contraction in GDP between September and October. This stagnation, leaving the output no higher than it was in January, paints a picture of an economy struggling to rebound from a series of unprecedented challenges.

“Despite these challenges, this further decline in the pace at which prices are rising offers a glimmer of relief for households grappling with rising living costs. Yet it has not translated into robust economic activity. Key sectors like IT, financial services and retail have seen a dip in output since the start of the year, indicating an economy that is yet to find its footing.”

James McManus, chief investment officer at Nutmeg, the digital wealth manager owned by JP Morgan, said: “Inflation in the UK is a story of two halves. While headline consumer price inflation (CPI) has halved from an 11% peak in late 2022 to 3.9% in today’s data, core inflation remains more stubborn after a peak of 7.1% in May this year. Today’s data shows the magic halving is yet to occur, with the rate for November at 5.1%.

“What’s more, headline inflation needs to halve yet again, if it’s to get close to the Bank of England’s illusive 2% target. And the drop from 4% to 2% could be tougher to achieve than the bigger drop we’ve already seen, given some of the more sticky elements.

“While energy prices are well below last year’s levels, food prices, which have slowed according to today’s data, are still 9% higher than a year ago. So food inflation – perhaps one we all feel most acutely in our weekly shops or eating out bills – still needs to come down dramatically.

Danni Hewson, head of financial analysis at AJ Bell, said: ““Let’s not be churlish, the latest UK inflation numbers deliver a welcome shot in the arm for the UK economy. Headline CPI fell to 3.9% in November, less than double the Bank of England’s two percent target, which will give markets faith that interest rates will follow the trajectory they’ve already bought into.

“Looking at rate expectation this morning there’s growing confidence cuts to the base rate could begin as early as March and that by this time next year the economic landscape will look very different – more than one in 10 are now betting rates could fall back to below 4% by next December.

“With around 1.5 million homeowners whose fixed rate mortgages are up for renewal in 2024, these numbers are likely to further increase competition amongst lenders to offer better and better deals.”